Twitter: @inaayaomer

November 18, 2022

Across the globe, news of an eventual economic crisis is widespread. Skyrocketing prices at the gas station, paying way more for weekly groceries at the store, and hearing about rising costs for used cars are clear signs of inflation.

Past examples of recessions include the Great Depression in the 1930s and the Great Recession in 2008. However, currently, there is a debate over whether or not we’re beginning to experience a recession on a global scale. Although it’s not been officially declared, signs of a recession have emerged in the economic state of numerous countries.

A term not to be taken lightly.

The Great Recession was a sharp decline in the global economy that occurred between 2007-2009. This refers to both the U.S. recession at that time and the ensuing global financial crisis in 2009. During this period of time, the world saw a decrease in the global unemployment rate by 10% and a decline in the gross domestic product (GDP) by 5.1%.

“The 2008 recession was driven by a housing crisis. There was too much lax lending for mortgages, especially subprime mortgages, and eventually, a lot of those loans were not any good; people were not able to pay it back. As a result, the financial system started to collapse,” said Tarim Wasim, a San Francisco Bay Area-based private equity investor and partner at Hellman & Friedman.

According to a report by the Financial Crisis Inquiry Commission in 2011, the Great Recession was avoidable. In the report, the commission noted the government’s failure to regulate the financial industry which included the Federal Reserve Board’s (Fed) inability to curb toxic mortgage lending. In addition, financial firms took on too much risk as the shadow banking system, a group of financial intermediaries that don’t go through as strict regulations as banks, rivaled the depository banking system (i.e. a bank you go to open a checking or savings account). So when “bad loans” were written by the bank and sold in the open market, the shadow banking system collapsed impacting the flow of credit to consumers and businesses.

“Because there were lots of bad mortgages that were not getting paid back, and banks were gonna go out of business, that was the trigger to the 2008 recession,” Wasim said.

An economic collapse as severe as this had not been seen since the Great Depression occurred in the 1930s. According to an article by The Investopedia Team, “there is a near consensus among economists that the downturn of the late-2000s, was not a depression.”

The Great Depression was the worst economic turndown in the history of industrialization which began after the stock market crash in 1929 which wiped out millions of investors, caused a decline in consumer spending, investments, and industrial outputs, and caused an increase in global unemployment rates that reached a peak of 24.9% with a GDP decline of about 26.7%.

According to people like Catherine Radley, Senior Director at Alvarez & Marsal Europe, we are headed for an economic recession yet again. Some may even argue that in parts of the globe, the recession has already begun.

“I think the U.K. is probably already in recession. Everyone else will probably follow, and it’s a question of whether it’s one quarter, two quarters, or longer,” Radley said.

According to CNBC, it is predicted that the UK is already experiencing a “moderate four-quarter recession.” This was caused by a number of factors including the inability of the U.K. to return to its pre-COVID economic state (being the only G-7 economy to remain so), rising credit risk, the China-Taiwan conflict, and the rise in the costs of fuel due to the Russo-Ukrainian War.

One of the situations with increasing economic effects is the China-Taiwan conflict in which China seeks a “peaceful reunification” with the self-ruled island.

“I just want to really dig into this because I still think it [the China-Taiwan conflict] is the biggest single story if we’re looking at the next 5-10 years. It’s the one thing that will change our lives as we know it because China is obviously where the solar panels are made. China is where wind turbines are made. 50% of all the profits of many of the major European companies are made in China and Taiwan is where 50% of the semiconductors are made,” said Rory Stuart in the podcast The Rest is Politics.

A possible invasion of Taiwan, which China has held off on for now could have negative effects on the economy on a global scale. In addition to this issue, the rising energy prices due to the Russo-Ukrainian war have also worsened the global economic state.

“We’ve got rising energy prices, which the government has borrowed some money for, but they’ve also borrowed a lot of money to fund tax cuts for the wealthiest, which hasn’t worked and has caused major unrest, which I think will make the recession in the UK, possibly worse,” Radley said.

Due to their close proximity to Russia and the ongoing war between Russia and Ukraine, fuel prices have drastically risen in European countries. Some argue it affects these countries more than others such as the U.S. However, the U.S. economy has still taken a hit and will possibly follow the U.K. in recession. This is partly due to the rise in gas prices which eventually led to inflation, but primarily due to COVID-19 and the effects it had on businesses and the economy as a whole.

“That’s one reason for the inflation [the Russo-Ukrainian war]. The other reason for inflation is that a lot of supply chains during the pandemic slowed down, factories were shut down, shipping was shut down, and the demand for goods in fact increased in 2020 and 2021,” Wasim said.

Despite the fact that people were stuck at home, during the pandemic, people were actually buying more goods, but the factories and supply chains were struggling to supply those goods due to them being shut down because of COVID-19. The imbalance between supply and demand caused an increase in prices which further led to inflation. According to Wasim, these are some of the short-term causes of inflation, but in fact, “there is no real end to inflation.”

“That has led to a set of reactions from the Fed. The Fed is the central bank of the US and they have a dual mandate. One is to keep inflation down, and the second is to keep unemployment low,” Wasim said.

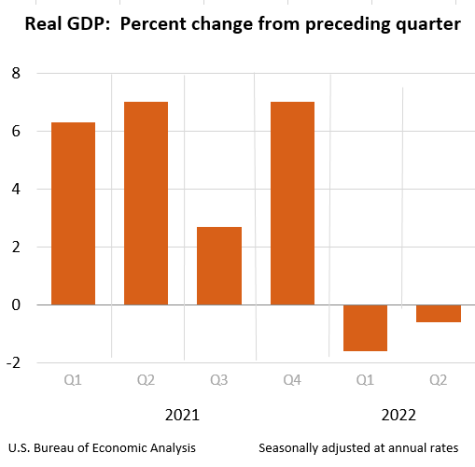

In a recent couple of decades, the Federal Reserve has been focusing on keeping employment high by keeping interest rates low and printing a lot of money. It is their job to monitor and set interest rates, manage the overall money supply, and have a responsibility to implement regulations for the financial markets. By making available “easy money,” they were able to allow businesses to borrow and make more investments, which in turn allowed them to create more jobs. Wasim compared the Great Recession to the current recession patterns of 2022 and stated that the causes were in fact opposing each other.

“The problem is, this time is different. What the Fed is now being forced to do is the opposite of what they did in 2008; which is they are having to actually tighten the money supply, and the way the Fed tightens the money supply is that they increase the borrowing rate that banks can borrow at. So, when they increase the borrowing rate, the rate you have to pay on loans as a consumer and as a business goes up,” Wasim said. “When that goes up, businesses borrow less, they can invest less and as a result, there is less capital available for growth. So the economy starts slowing down.”

The current issue is the combination of the demand going down from consumers due to the pressure of inflation, and the decline in capital investments causing businesses to slow down. As a result, this is what leads to a recession.

“When businesses slow down, their profits don’t grow as fast, which means their value goes down. It’s a double whammy, because, on the one hand, the businesses won’t grow as much, but then the second thing that happens is the higher discount rate. When the discount rate goes up, the present value of that same stream of cash flow actually goes down because you’re using a higher rate of discount,” Wasim said. “So businesses are worth a lot less when you hit a recession.”

In addition to the effects that signs of a recession have had on the global economy and businesses, rising costs and unemployment rates have consequently impacted college students and graduates entering the workforce.

“A lot of investors are becoming quite iffy, because I was in the startup space and we were trying to get investors to invest in the company that I was interning at and people definitely had their doubts about it because they thought these companies weren’t going to go up because there’s no actual standing in the economy right now,” said Tanaya Gadre, a junior pursuing a business/economics major at the University of California Los Angeles (UCLA). “If people think that we’re getting into a recession, a lot of companies will just declare that they don’t want to hire at all.”

Another factor to take into account is how companies are approaching this downturn.

Jake Adams*, a senior at UCLA pursuing a computer science major, interned at Apple during the summer of 2022 and used to have plans to work there full-time after graduation. However, due to the uncertainty of what the future holds for the global workforce, he decided to take a different path.

“My company, they kind of hit us like ‘go do your masters, wait it out here, let the economy jump back a little bit, and then join us full time.’ So that’s kind of the path that I’m on,” Adams said.

Due to its size, Apple’s “not like other companies that just said, ‘we’re not hiring new grads, we’re laying off people,’” Adams said. “Apple is not one of those companies, I guess where the difference lies is that due to the recession they’re trying to be more cautious and in that being cautious, they’re trying to just anticipate a potential slowdown in the future, which is why the advice I got from my leadership was to wait it out and it may be safer to join full time later on.”

Despite rising costs, budget cuts, and unemployment rates, a decline in salary is not as big of an issue. According to Adams, at least within the tech industry, in recession or not, you see higher salaries.

“So especially these big companies, either you see them, offering you a job or you don’t get the job, but usually they try to maintain the level of salary just because it’s in tech,” Adams said.

The path the global economy is currently following points towards a global recession, and these early signs have already begun to affect multiple industries such as real estate, manufacturing, tech, and more.

Stuart said, “People are beginning to say that this is feeling like the bursting of the tech bubble in 2000, that this is gonna involve trillions wiped off the value of these shares.”

*In accordance with Carlmont Media’s anonymous sourcing policy, this source’s name was changed by the authors to ensure anonymity and prevent damage to their professional reputation and career.