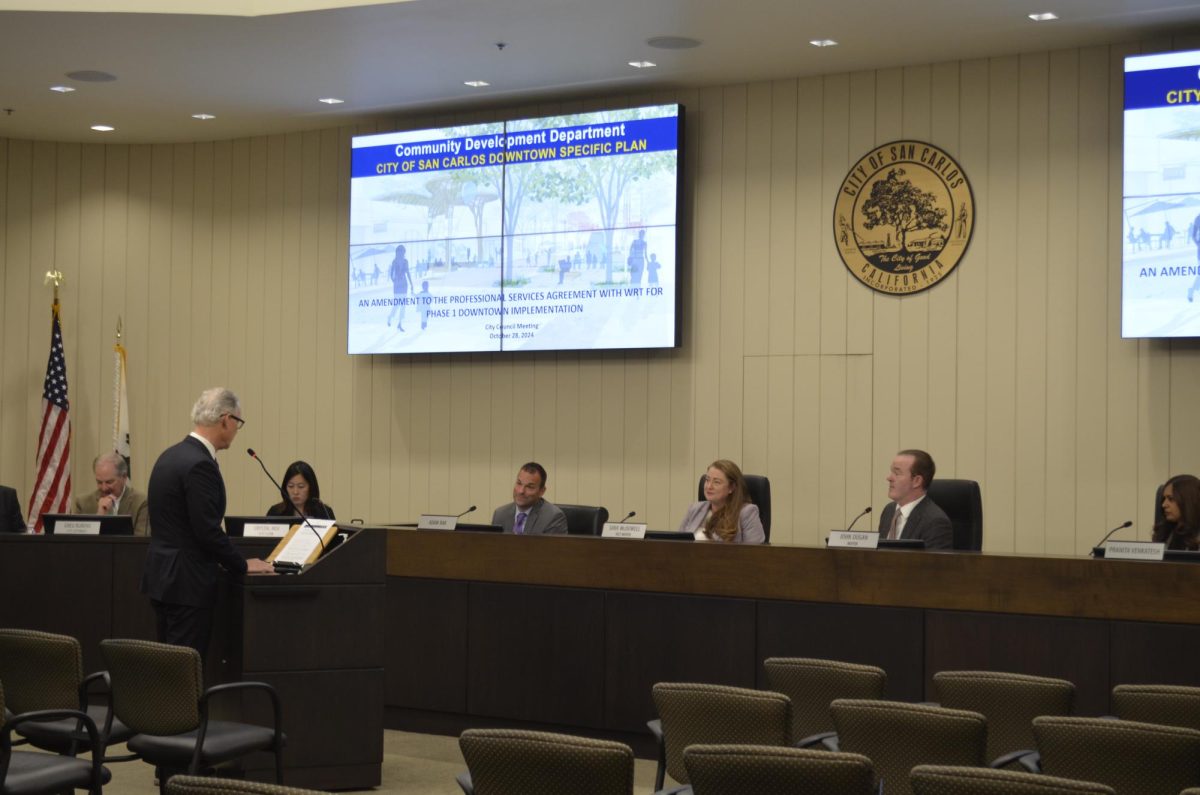

After the Belmont City Council unanimously approved voter consideration, a new tax measure will be on the city’s November 2024 ballot.

Measure DD, a business tax measure, aims to update Belmont’s business license tax system.

The five-member City Council agreed that the current system is outdated and very unfair towards small business owners, who pay almost as much in taxes as large businesses.

“What happens is that some of our business owners who make the lowest amount of money are paying a tax rate that’s 50 times the amount of the people who are the highest earners,” said Belmont Vice Mayor and City Council Member Gina Latimerlo. “So it’s kind of nuts that anybody thinks this is fair.”

The City Council’s decision puts emphasis on efforts around the country to make large corporations pay their fair share of taxes.

The measure would lower the base tax rate from $341 to $25 per year, an almost 92% reduction. It would also expand tax exemptions, reduce the amount of business categories, and crack down on cannabis businesses.

Many Belmont residents support the measure, as it would benefit almost 60% of businesses in Belmont by lowering their taxes. However, the plan faced some resistance from businesses that would be impacted by a tax increase.

While the overall response from residents is positive, some are also concerned about possible exploitation of the new system.

“I like the idea of fairness,” said Michelle Peng, a sophomore at Carlmont. “But people are probably going to find loopholes and butcher it.”

Despite concerns, City Council members believe that this will be a huge step forward in helping Belmont’s small businesses thrive, and serve as an example to other cities.

“We really did wild amounts of community outreach and then came up with reasonable numbers, and not trying to screw big business, because that’s not what we’re trying to do,” Latimerlo said. “I think it would be great for other cities to emulate.”

Some residents are just happy that small businesses will flourish in Belmont.

“I agree with Belmont’s new tax system because the lower tax helps the small business communities and lets them spend more of their profits on their items,” said Charlene Xu, a sophomore at Carlmont.

Belmont’s current business tax system was created 48 years ago and hasn’t changed since. “It’s really confusing. A lot of business owners call our city to try and figure it out; they don’t know what to pay,” Latimerlo said. “The goal of what we were doing really is just fairness and justice.”