Most people spend more than 12 years of their lives in a classroom. During these 12 years, they are bound to meet at least one teacher who significantly impacted their lives.

Whether it was due to how they made their students feel supported and valued or made learning complex concepts easy to comprehend, attracting and retaining talented teachers like these is becoming more challenging due to average teacher salaries coupled with the high cost of living in the Bay Area.

Inadequate salaries

According to Indeed, the average base salary for a San Francisco Bay Area teacher is $53,824 annually. Similarly, the annual salary for the average worker with a Bachelor’s degree in San Francisco is $61,956, according to ZipRecruiter.

This means that, on average, a teacher is paid $8,132 less than someone with the same level of education.

Tina Wu, who has been a Bay Area real sales agent for five years, says that most of her clients work for high-tech companies. When it comes to purchasing a house their budget is between 4 to 5 million. Bay Area teachers can not compete with the salaries of high-tech workers and their purchasing powers.

“Most schools in the Bay Area do not pay teachers enough. While we are considered professionals with degrees and certifications beyond a bachelor’s, we are not paid as a typical professional in the field,” said Kelly Redmon.

Redmon, the Sequoia District Teachers Association (SDTA) representative for Carlmont High School, has taught at Carlmont for 22 years and currently teaches English I and English I Support.

In the same district, SDTA president Edith Salvatore has taught Spanish at Sequoia High School for 29 years.

“For 2023, the median income for a single individual in the Bay Area is $125,000, making $104,400 the level the government identifies as low income. A teacher must work roughly a decade before they even reach the low-income mark, and must work twelve years as well as have 60 units beyond their bachelor’s degree to hit the median income,” Salvatore said.

For families like Salvatore’s, where a teacher brings in the sole income for the household, the situation is even worse.

“If you are a family of four, as I am, you only hit the low-income mark of $149,000 after a quarter century with 75 units past your bachelor’s, and you will never hit the median income of $175,000. This means that teachers must rely on a partner’s income, or inherited generational wealth, to be able to purchase a home or even to avoid living with roommates,” Salvatore said.

If her family was not in a position to help her financially, she would have been forced to move to a more affordable area. Unlike Salvatore, many teachers do not have the same support system when purchasing a house.

In order to combat these issues, some teachers have turned to working multiple jobs.

“I have done tutoring. I used to run the SAT/ACT testing here at Carlmont on the weekends. I used to do Instacart. I still participate in market research and focus groups for extra cash now and then. Sometimes, I will cover as a substitute for a colleague if needed. I live a very blessed life, and all my needs are handled. That being said, if there are wants or special occasions, I will try to earn a little extra from time to assist with these extras,” Redmon said.

This is the reality for 1 in 5 teachers who work a second job according to the California Teachers Association.

Salvatore is also a part of that 20%.

“I have worked for the Giants as an usher for the past 35 years. I kept the job both because I’m a fan and enjoy it, but also because it supplements my income and has allowed me to take vacations, rather than just cover my bills,” she said.

The reality is teachers do not get paid at the same rate as their college-educated counterparts. Due to this many teachers have multiple jobs in order to afford things like family vacations and other leisurely activities.

At the end of the day, despite living in a dual-income household and working multiple jobs to make ends meet, some teachers have no choice but to move to a less expensive area.

“We see many teachers choose to leave the area, or the profession, after a handful of years because they’ve gotten to a point where they want to buy a house and raise a family, and that isn’t possible here,” Salvatore said.

The high cost of living

For most Bay Area teachers, renting or owning a home within their school district is out of the question.

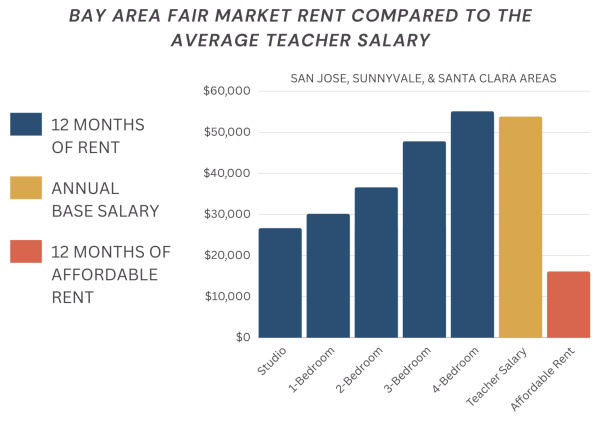

According to Zillow, rent is affordable if it is 30% or less of a person’s salary. Based on this, for the average Bay Area teacher making $53,824 annually, affordably renting a $2,223-a-month studio apartment would be beyond their reach.

“I would not be able to afford the house I live in without the assistance of others. My husband and I have always needed both of our incomes to make it, and we have almost always lived paycheck to paycheck with very little in savings. If it wasn’t for the dual income, I would most definitely need to rent a studio or an in-law unit because I would not be able to afford much if I lived on my own,” Redmon said.

In addition to renting a home that is beyond affordable, some teachers face the additional expense of childcare.

“The other variable that I believe affects teacher retention, at least for teachers with families, is the combined high cost of living in the Bay Area with the incredibly high cost of childcare,” said Addison Gaitan, an English teacher at Carlmont for nearly 10 years.

In order for some teachers to be in the position to buy a home, they have to rely on the help of family. Redmon, who has never been able to afford a home on her own, was only able to do so by moving in with her elderly parents.

Despite receiving financial aid from family, some teachers like Salvatore, a single mom of three, still need a roommate to help pay the mortgage.

“I own a home in San Francisco, thanks to my family. I own the house with my brother, which my parents gave us the money for the downpayment when we purchased it in 2010,” Salvatore said.

In response to the housing crisis in the Bay Area, companies like Landed offer homeownership programs to individuals like teachers, firefighters, nurses, and other public servants. According to the company’s website, Landed knows how difficult it is to become a homeowner and works to guide the next generation to homeownership.

Maria Robinson, a Spanish teacher at Carlmont High School for more than ten years, would not have been able to buy her home without Landed’s help.

“I do not think we could have afforded a home because the prices had begun to rise. Since we had already sold our home in Southern California, our savings would have not been able to catch up with the higher prices in the Bay Area,” Robinson said.

During the time Robinson and her husband were in the market for a new home, Landed was being promoted by her school district. After reaching out to the company’s representatives, she found the application process quite simple, and soon after, she became a homeowner.

Attracting and retaining talented teachers

School districts across the Bay Area have devised various solutions to attract and retain talented teachers. Some districts like SUHSD have responded by increasing teacher salaries. Salvatore supports paying teachers more but has noticed an underlying issue.

“The main thing the district can do to help with the cost of living is to pay us more, which this recent contract has helped to do. But as the cost of living rises for teachers, the district’s expenses rise as well,” Salvatore said.

This double-edged sword means that some districts are able to pay teachers more due to high property taxes. On the other hand, such teachers are still unable to live in these expensive areas where their school district is located.

“Our teacher’s union is amazing at negotiating a fair contract and helping teachers get a salary that supports living costs in the Bay Area. However, even with all the negotiations, teachers are still barely making it,” Redmon said.

To combat this issue, districts like the Jefferson Union High School District (JUHSD) have implemented a program that offers affordable housing units for teachers. In the spring of 2022, the district opened the doors of its 122-unit educational staff housing complex at 705 Serramonte Blvd in Daly City.

According to a promotional video by the district, the complex is one of California’s and the nation’s first educator housing projects and is exclusively for JUHSD teachers and their families. Tina Van Raaphorst is the deputy superintendent of business services at JUHSD.

According to Van Raaphorst, the start of the school year, following the opening of the housing unit, saw the district fully staffed. An additional benefit was reduced turnover rates, which is the percentage of employees leaving the district.

Van Raaphorst accredits this to the housing complex allowing teachers to live and work in the area affordably.

“All districts should have something like this, especially for newer teachers that want to get into teaching but can’t afford to live on their own in the Bay Area,” Redmon said.

Districts with affordable housing programs like JUHSD help attract and retain effective teachers within the district. In the long run, this benefits students by creating a sense of stability as staff remains consistent.

While some school districts are able to offer housing assistance to teachers, many others are far from implementing this program for teachers

“On average, condos sell for $1-3 million and a single-family home will go for $2-3 million,” Wu said.

Due to these excessively high numbers, in order to live and work in the Bay Area, teachers need financial aid for homeownership.

“The cost of living in the Bay Area makes it very difficult for teachers to set up roots in the area and create a long-lasting career,” Salvatore said.