The beginning of spring brings a sense of anxiety as Tax Day approaches and many individuals become stressed out by their tax reports.

In order to aid taxpayers, the Belmont Library provided a free service that allows locals to ensure their taxes are filed correctly.

“We partnered with American Associations of Retired Persons (AARP) to provide free tax filing services for all,” said Theresa Saito, a librarian. “It is appointment-based and we serve anyone that signs up for it, we do not only focus on the elderly.”

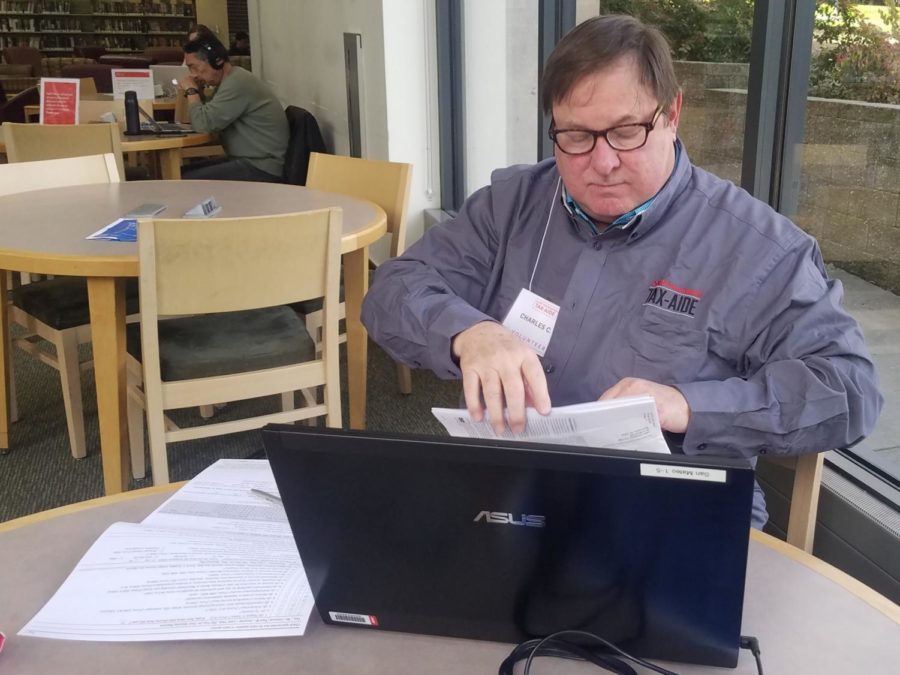

In order to help the locals with their tax forms, the library focuses on providing space for the volunteers and their clients.

“This season we have four volunteers that were sent by the AARP,” said Karen Mariro, a librarian. “Every Saturday before the Tax Day, people use the library as a community space that allows them to spend some time filing their taxes.”

Tax Day, April 15, calls for all individuals to report their income and attempt to get as many deductibles as possible.

“We mostly serve lower and middle-income individuals,” said Jim Cole, district coordinator. “For the most part, people are concerned with their taxes not [being] done right and whether or not they are getting as many deductibles as possible.”

In order to address these concerns, AARP trains its volunteers to be prepared and updated on the standards that the Internal Revenue Service (IRS) has for the taxpayers.

“AARP sends us trained volunteers that help out with the forms,” said Saito. “This year, the 1040 form was simplified which made the process different. People that have been doing their taxes on their own for years are now a little confused with the new forms and need some extra assistance.”

The service that the library and AARP provide is free and is analogous to the individual tax services that some people choose to get.

“Our counseling is very similar to private tax counselors,” said Saito. “The only difference is that our counselors only focus on filling out the forms whereas other counselors focus on getting as many deductibles as possible.“

Even though the services that the library provides are not the same as an individual, their wide availability makes them beneficial for all the members of the community.

“We really try to help everyone that needs help with their taxes,” said Cole. “We save people anywhere from $300 to $400 on additional tax counseling services that might be necessary for them.”