Ever since the Great Recession of U.S. financial markets in 2008, businesses have been looking out for a potential event similar to it. The recent stock decreases due to COVID-19 have been impacting large companies and may be a possible precursor to a second recession.

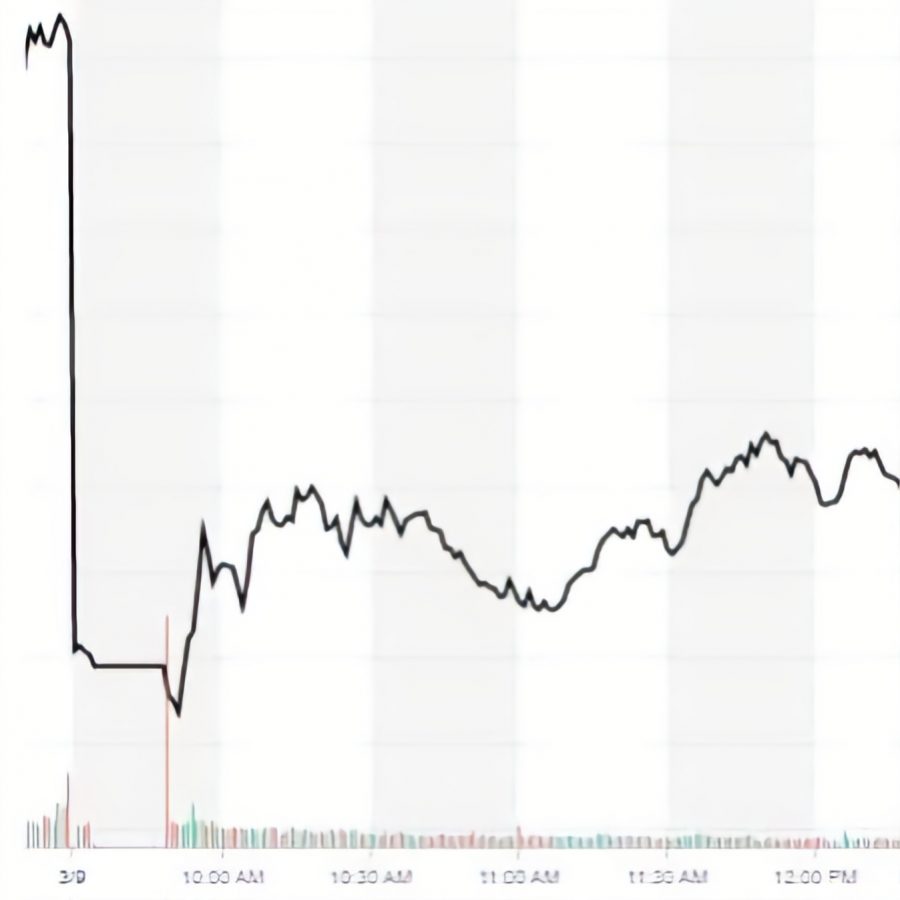

On March 9th, the Dow Jones Industrial Average saw a crash of more than 2,000 points, the worst decline since 2008. The sudden drop in Dow Jones reflects the financial stocks of the 30 largest U.S. companies, revealing a decrease in wealth for investors and businesses nationwide. All of this happened within a single day.

Similarly, in 2008, a sudden increase in risky home loans prompted a subprime mortgage crisis that led to a significant decrease in home values. During this period, the S&P 500 Index, which tracks the stocks of the top 500 U.S. companies, fell by over 57%.

After this significant financial dip, many fortunes were ruined, and some people were even forced to file for bankruptcy. Some think that the likelihood of a newer recession is high, as recent financial events reflect down-trending patterns.

“The recent downfall of stocks is no accident,” said Leo Shohet, a student at Carlmont. “The decline will most likely speed up as people become less confident.”

When stocks are generally performing well, the chance of potential plummets in value rises. In economics, this phenomenon is often referred to as a “bubble.” When stocks increase, they are compared to a bubble growing in size. But when a stock crashes, the same bubble is seen bursting. Some economists believe that we are nearing a bubble “popping.”

“Large things happen when people invest in the right markets, such as today,” said economist Gary Shilling. “When things get too large, it often creates exploding bubbles.”

The value of stocks is primarily controlled by shareholders or those who purchase shares. This creates a system in which companies are held accountable by shareholders and depend on them.

However, when external factors come into play, shareholders may decide to sell stocks not based on company success but instead because of other reasons. Sometimes, decisions are seen as “random,” making some small decreases temporary.

“Lots of people and factors contribute to the stock market,” said Joshua Kennon, an economist. “The ups and downs, even on a significant level, can be attributed to randomness.”

Regardless of whether a future recession will take place or not, many businesses remain concerned about the potential outcomes of a risky economy. The fear of a downturn alone may drive economic losses. For everyone, it is unsure when our “bubble” could pop within a near or far period.

“Stock trading is all about predicting the future,” Shohet said. “Predicting it correctly is the art of economics.”