Political analysts have been predicting the political and economic downfall of the United States since the beginning of the decade, but recent global developments such as the rising power of a new world order and the progression of China into Middle Eastern politics, have hit the final nail on the U.S.’ hegemonic coffin.

Following the 1944 Bretton Woods Agreement, the then gold-backed U.S.D. (United States Dollar) replaced the British Pound Sterling as the world’s primary reserve currency. After long debacles in the Vietnam War, in the 1970s, President Richard Nixon decoupled the dollar from the gold standard, making the dollar a fiat, floating currency.

A reserve currency is a strong foreign currency possessed by central financial authorities across the globe in massive amounts to use for international dealings such as trade, sanctions, and foreign transactions.

For example, if a business in the Philippines were to trade with one in India, they would trade in a reserve currency: the dollar, as it is easily convertible and a stable source of value. Exchanging in reserve currencies lowers exchange rate risk and provides greater buying power.

Understanding the power of the U.S.D.

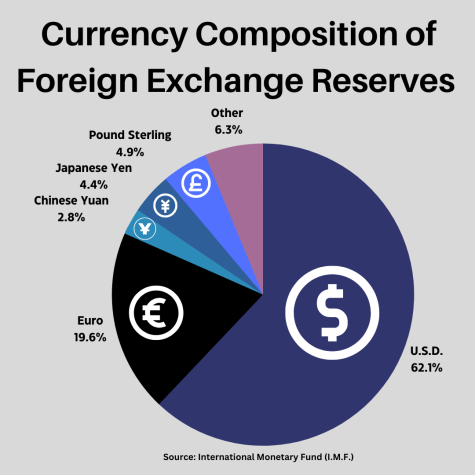

Today, the Congressional Research Service reports that central banks hold about 60% of their foreign exchange reserves in the U.S.D., followed by 20% in Euros, and approximately 3% in the Chinese R.M.B..

There are various benefits, economic and political, of controlling the world’s major reserve currency:

- Lower borrowing costs: As the world’s current major reserve currency, the U.S.D. benefits from high demand, allowing the U.S. government to control interest rates. This significantly reduces the cost of servicing the national debt and allows for greater spending flexibility in the global economy.

- Increased financial stability: The major reserve currency status of the U.S.D. contributes to the stability of global financial markets, making it a safe haven for investors during times of economic instability.

- Increased economic influence: As the major reserve currency, the U.S.D. allows the U.S. government to exert influence over other countries through economic policies and trade agreements. Because of this, the U.S. has significant political and economic influence on the global stage.

- Increased demand for U.S. services: The U.S.D.’s status as the world’s major reserve currency means that it is widely used in international trade, therefore translating into increased demand for U.S. goods and services, thus benefiting the U.S. economically and strengthening the U.S. manufacturing industry and marketing supply chain.

- Reduced exchange risk: The status of the U.S.D. as a major reserve currency implies that other countries hold large reserves of the currency, thus reducing exchange rate risk for the U.S. and increasing the stability of the currency’s value.

The power of the dollar may be the only reason that the U.S. still holds as much political influence as it currently does. Following grave foreign policy missteps and continuous economic instability, it is unlikely that the U.S. would remain a political superpower without the economic influence of its currency.

Currently, the dominance of the U.S.D. serves as a cushion for the U.S. economy. If, for whatever reason, the U.S.D. was suddenly replaced by a new major reserve currency, it would guarantee economic collapse for the United States, following a similar path as taken by the English Pound Sterling almost 80 years ago.

Devaluation, usually accompanied by general price inflation, would plague the American economy. As observed in the U.K., the British pound lost its official reserve currency status to the U.S. dollar in 1944. Between 1935 and 2005, prices in British pound territory exploded upwards of 5000%, or approximately 70% annually, compared to the 1% annually in the previous two centuries, according to American economist James Rickards in an article for the Daily Reckoning, a prominent publication for market analysis and economic predictions. It is likely that the U.S. would follow suit, suffering long periods of high inflation rates and even economic depression.

Not only would this impact the U.S.’ political influence on a global stage, it would impact everyday Americans– shelling millions out of workers’ pockets on an annual basis.

Will the Chinese R.M.B. replace the U.S.D.?

According to recent data published by the I.M.F. (International Monetary Fund), the share of the U.S. dollar reserves held by central banks fell to 59%– it’s lowest level in 25 years– during the fourth quarter of 2020. I.M.F. analysts say this partly reflects the declining role of the U.S. dollar in the global economy, in the face of competition from other currencies used by central banks for international transactions.

While the U.S.D. shares dropped 12%– from 71% to 59%– since 1999, the share of the Euro has fluctuated around 20%, while the share of other currencies including the Australian dollar, Canadian dollar, and Chinese R.M.B. climbed to around 10% in the fourth quarter of 2020.

Contrary to the fears of many economists, despite the R.M.B.’s rise in the global economy, it won’t overtake the U.S.D. in the near future.

To understand why this is the case, it is important to analyze the factors that put the United States dollar in its current position. Most countries have elected to hold the bulk of their reserves in the U.S.D. because the U.S. meets the following requirements:

- Large, liquid financial markets capable of taking large investments. As of 2022, there are currently at least $7.2 trillion dollars in reserves held in U.S.D. according to the I.M.F..

- A reputation for safety and economic transparency. Because of the United States’ less questionable moral code, and more importantly, increased levels of economic transparency, other countries are willing to invest billions of dollars in the country’s government securities.

- A willingness to run current account deficits indefinitely. If the U.S. runs a financial account surplus, by definition it has to run a current account deficit. The current account mostly consists of trade in goods and services. Thus, the fact that the U.S.D. is the world’s major reserve currency is one of the main reasons why the country has run a current account deficit for the majority of the last three decades.

Because the Chinese government, and consequently the R.M.B., doesn’t hold much global confidence, it would be incredibly difficult for the Yuan to overtake the dollar. Nevertheless, that hasn’t stopped China from making what Cardi B would call “money moves.”

A new world order (sans America)

As the United States continues to struggle with its foreign alliances, China is making headway in securing foreign control.

China knows that the enemy of an enemy is a friend– and the U.S. has no shortage of enemies. With various nations trying to break away from an American-controlled political system, China is taking advantage of every alliance the U.S. is losing.

B.R.I.C.S. (Brazil, Russia, India, China, and South Africa) is a relatively new, but powerful alliance between nations attempting to become independent of American political influence.

In addition to becoming a strong alliance against the U.S., B.R.I.C.S. is also attempting to form a new world currency, according to the U.S. Gold Bureau. While their new “currency” may not be as successful as the dollar, their objectives are clear: de-dollarization.

China and Russia have been stockpiling large amounts of gold at an unprecedented rate for the past year.

A clear reason for this is China’s preparation for war. U.S. military personnel have confirmed China is preparing for war to annex Taiwan, but haven’t provided a timeframe.

China’s behavior seems eerily similar to Russia’s before the invasion of Ukraine. Contrary to popular belief, Russia is not economically devastated by the U.S. and N.A.T.O. sanctions. The B.B.C. reported that despite grave expectations of a 15% decline, the Russian economy only declined approximately 2% in 2022.

This is because Russia de-dollarized its economy and stockpiled gold and the Chinese Yuan. Because of its limited dependence on the greenback, Russia was able to survive disastrous sanctions by the most powerful nations in the world.

China has been negotiating trade agreements outside of stockpiling gold– thus suggesting that an attack against Taiwan may happen sooner than U.S. officials predict.

Furthermore, it seems that B.R.I.C.S. countries are committed to overthrowing the dollar’s international hegemony. Since Russia’s invasion of Ukraine, various nations have distanced their economies from the dollar. For example, Egypt recently announced it will begin to unpeg the Egyptian Pound from the dollar. It seems, along with Egypt, that Brazil, India, Turkey, Qatar, and many other countries have begun to stockpile gold– working collectively to overthrow the dollar.

China: The global-peacekeeper?

It is no secret that the United States is responsible for much of the tensions in the Middle East. Yet, it may come as a surprise to most that China has stepped up to play global peacekeeper.

China’s efforts in brokering a detente deal between Iran and Saudi Arabia have been seen by analysts as a broader message: a changing world order.

The diplomatic power-vacuum left by the United States in the Middle East has been filled by China. Obviously, this isn’t a good look for America on a political or economic front.

The “champion of democracy” has once again squandered another alliance, squaring China a perfect opportunity to play savior. Politically, this is a massive failure for the U.S., as Saudi Arabia was a significant ally in the Middle East.

Oil began to dominate the world energy mix after WWII, with the O.E.C.D. (Organization for Economic Co-Operation and Development) accounting for 70% of world oil consumption, according to O.P.E.C. (Organization of the Petroleum Exporting Countries).

Because of the global economy’s reliance on oil countries, the U.S.’ relations with oil countries like Iran and Saudi Arabia are directly tied to its hegemonic power. In order to maintain economic hegemony, it is necessary to maintain favorable relations in the Persian Gulf.

Gulf countries aren’t allies that the U.S. can afford to lose, especially not to China. As China eases into comfortable relations in the Middle East, the U.S. is struggling to recover its lost allies.

What now?

It is clear that the U.S. government has handled its economic problems as well as it does any other problems: disastrously. From elementary foreign policy fumbles to losing powerful allies left and right, it has become obvious that the era of American domination is waning and the tides are turning.

While the change will not be immediate, it is important to start noticing the signs of a shifting world order in its early stages.

Contrary to popular belief, what happens on the global stage does impact the everyday American. For many, de-dollarization could mean a continued economic down spiral, a worsened recession, or even an economic depression rivaling that of the late 20th century.

While many economists suggest investing in metals or going on saving sprees– however, the best way to prepare for the future is to stay informed on economic policies, international affairs, and current events. Knowledge is power, and right now, Americans need all the knowledge they can get to weather the incoming economic storm.

Eden R. • Apr 30, 2023 at 12:56 pm

This is a very well-researched article that thoroughly explains such a complex economic topic from start to finish. This isn’t normally a topic that high schoolers are aware of to such an extent– in fact, there are many adults who wouldn’t be able to explain the topic as thoroughly and analytically as you did. As someone who doesn’t pay much attention to international news, I learned a lot from this article. I especially liked that you connected such large global issues to the everyday American. These are the types of articles that should be published in media today. We, as Americans, really don’t focus much on conflicts outside our direct bubble. I’m glad that young writers, like yourself, are bringing awareness to these issues.