Martha Smith from Venice, Florida was unable to pay off her student loans in a timely manner and had to consolidate it all into one account to be eligible for debt forgiveness.

Then, she realized that she had already accumulated $7,000 in interest.

A student from Michigan worked as a teacher for 10 years but was denied public service loan forgiveness because their school did not qualify. As a result, they had to leave teaching in hopes of finding a higher-paying job, however, the loan interest alone was higher than what they could afford on their pay. “The payments I do make can’t even cover the interest they keep adding to my principal,” they wrote.

Linda LaFuente from Waukesha, Wisconsin, refused to stop her autopayments even when she was struggling with food insecurity in an effort to avoid high-interest rates. However, when the system changed in early September, the loan company paused her loans without informing her and added additional interest on top of her current loans.

“This was not a mistake made by me but by my loan company, costing me more money than I should have to pay,” LaFuente said.

According to the Student Debt Crisis Center, these stories are based on real testimonies of post-college Americans struggling with the economic aftereffects of higher education that thousands of students face.

With student debt and tuition in the U.S. constantly rising, many students and graduates struggle to pay bills and put food on the table. According to an article from debt.org, the stress caused by owning large amounts of debt can be equivalent to the damage of getting a car repossessed or losing electricity.

As this issue continues to appear in modern life, many high school students ask themselves, “Is college even worth it?”

Applying to College

As high school juniors prepare for college applications, on top of balancing their academics and many employments, they begin to scope out dream schools and recommendation letters. The stress of these applications is vast; acceptance rates continue to decrease and a college education has become needed for a promising career.

“It really helped receiving feedback on the written responses as well as receiving assistance on filling out the information for the applications correctly,” said Calista Savay, a current freshman at the College of San Mateo. “But also reach out to a college coach and your parents for filling out other aspects of the application.”

With multiple college essays, recommendation letters, and transcripts to maximize the chances of getting into college, students must keep track of these multiple deadlines, on top of academics, extracurriculars, and their social lives.

“Make sure you’re staying on track with due dates and schools but also allocating at least 30 minutes a night. Take a look, do some of it,” said Maxine Cheney, a current graduate school student and high school teacher.

According to Common App, college applications are due throughout the winter, even as early as mid-November for early-decision applicants. When the decisions come out during the spring, students must choose where to spend their next four years.

“I picked my college because I wanted to go someplace I felt comfortable in and I could see myself walking around, and they had the subjects that I was interested in,” Cheney said.

While students sift through their college acceptances, they begin researching the many aspects of the college. Urban or suburban, small or large, safety, and food services are among the elements they consider. According to College Matchpoint, 62% of college students believe a college’s brand name is a deciding factor. However, many others believe that it does not matter and instead, students should focus on the community and people.

“People are what help make your experience, so choosing a school where you connect with the professors and students is important to think about,” Savay said. “Another very important thing to consider is the duality between a social life and your course load.”

Yet, with this choice comes financial responsibilities, and many look towards tuition and their financial situation when choosing a school.

Debt on the Rise

According to Cheney, there is no required timeframe to pay off most student loans, however, it continues to gain interest. Students may be prepared to pay the initial loan, yet high-interest rates can quickly double their debt.

“Particularly with student debt, is that when students graduate, and they haven’t been paying their debt, there are big issues as there gets to be a lot of interest,” said Sean Tonra, communication associate at the Student Debt Crisis Center.

A cause of the student debt crisis has been rising tuition rates. According to the National Center for Education Statistics (NCES), when accounting for inflation, tuition rates have more than doubled in just 30 years, going from an average of $6,704 in the 1991-1992 school year to $14,307 in 2021-22.

According to Federal Student Aid, interest rates are growing steadily; likewise, so has student debt. When students aren’t careful, their debt can quickly double and, in many cases, trap them and drag them away from certain careers and jobs.

“I don’t think the information is made clear enough. A lot of people enter a loan because they have to, but they don’t really know what they’re signing up for, they don’t have all the information regarding their loans,” said Thomas Banner-Haimes, a current college freshman.

According to Cheney, with loans being taken out for the trimester or semester, students may have to drain their savings account to pay for their education.

“You could have a $3,000 dollar loan or more. That means over the next four years, you could have almost $12,000 worth of student debt,” Cheney said. “And that’s still accruing interest.”

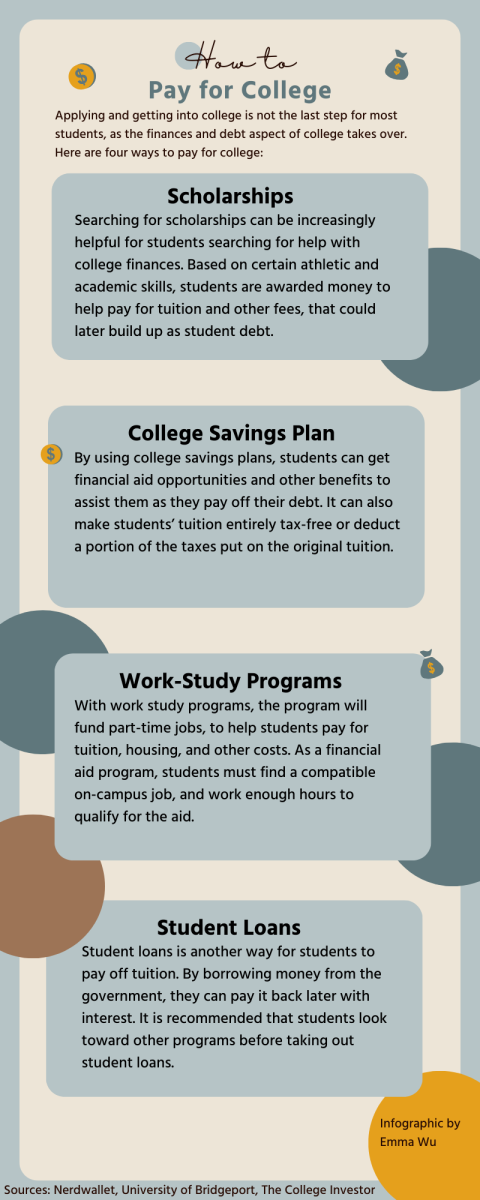

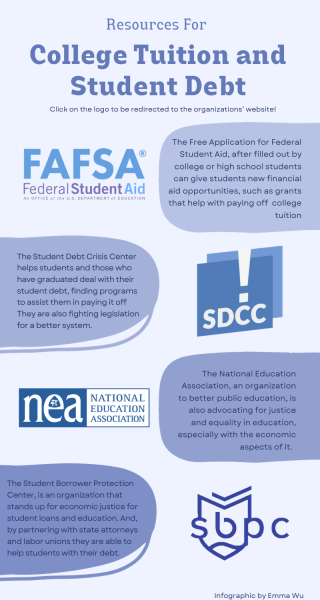

However, with many thousands of dollars of student debt comes resources found throughout high school and college to assist students struggling financially. For instance, reaching out to college counselors and Free Application for Federal Student Aid (FAFSA) can be incredibly helpful for students stressed about monetary issues.

“For college finances, definitely FAFSA. There, you can check and see if there are grants and it’ll be very helpful for paying tuition off,” Cheney said.

These student aid programs can help pay off your college tuition and sometimes cover most of the fees. According to Rose Yun Negrete, a current College of San Mateo counselor, applying earlier for programs such as FAFSA can allow for them to cover more of a student’s fees, decreasing the amount of debt they might have in the future.

“Students hesitate to apply to transfer to UCs because they look too expensive, but you could end up paying little or no tuition because of financial aid,” Negrete said. “You won’t know exactly what you qualify for unless you apply.”

Life After Graduation

The main factor when asking if college is the right choice compared to other post-high school options is how it affects someone’s career, housing, and life after graduation. With the rising tuition and housing prices, many prospective students wonder whether going straight to a career path would reap greater results.

Unfortunately, for many, that isn’t plausible.

“In the current job market, it is almost essential for workers to have at least an undergraduate degree,” Tonra said. “That’s why student debt is viewed as such an important issue; people essentially have to take on this debt.”

The Associate Public of Land-grant Universities states, “In 2021, median income for recent graduates reached $52,000 a year for bachelor’s degree holders aged 22–27. For high school graduates the same age, median earnings are $30,000 a year.”

This difference is what pushes students to go into college and take on the debt.

In the fall of 2020, The Hope Center, a national research organization run by students at Temple University in Pennsylvania, surveyed over 195,000 students across 202 colleges. In this survey, they found that three in five college students faced some sort of basic needs insecurity, 48% were affected by housing insecurity, 34% by food insecurity, and 14% by homelessness. In this same survey, they also found that 52% of these struggling students said that they did not have access to financial aid because they did not know how to apply.

“For many people who enter college coming from low income families, they have to take on debt. And a lot of them end up having food insecurity because they have to make these decisions between ‘Do I pay my debt this month?’ or ‘Do I go to the grocery store?’” Tonra said.

The housing insecurity continues past graduation. For many college graduates, purchasing a house, starting a family, or even buying a car can be impossible. According to a real estate data provider Attom report, out of 578 US counties analyzed, 547, or 99%, had unaffordable housing compared to the average income. Coupled with student debt, owning property largely remains a dream.

Why Go?

As students ponder the question, “Is college really worth it?” they must face the facts. Student debt in the U.S. is in a crisis. Borrowers face ever-increasing levels of interest and loans designed to trap them in their debt before they even graduate. With today’s job market, a degree is almost essential to get any well-paying job.

These factors of college debt contribute to the housing crisis and hunger in the U.S., as borrowers are forced to choose between making their loan payments or the week’s groceries. While data and personal horror stories can seem imposing to future or current borrowers, the key in this crisis is to stay informed.

So, why go to college?

Even with the constant stress of college tuition, student debt, applications, and other fees, such as housing and food, college continues to be an important aspect of many students’ lives and education.

“The biggest advice I give is just knowing what you’re signing up for,” Tonra said. “As we see the workforce shift with more and more careers requiring some form of higher education, college continues to be a necessary part of someone’s education.”