No matter what country or state, almost everybody agrees that teachers make up a crucial role in society. Unfortunately, California is experiencing a massive teacher shortage.

Legislators in California recently introduced a bill that would offer educators tax breaks in an effort to keep them in the classroom and combat the state’s growing teacher shortage.

“It’s time California leads the nation and sends a clear message to all current and future teachers: You are valued and California will reward your commitment to California’s kids and future,” said Bill Lucia, president of the Sacramento-based lobbying and research organization EdVoice, to the Los Angeles Times.

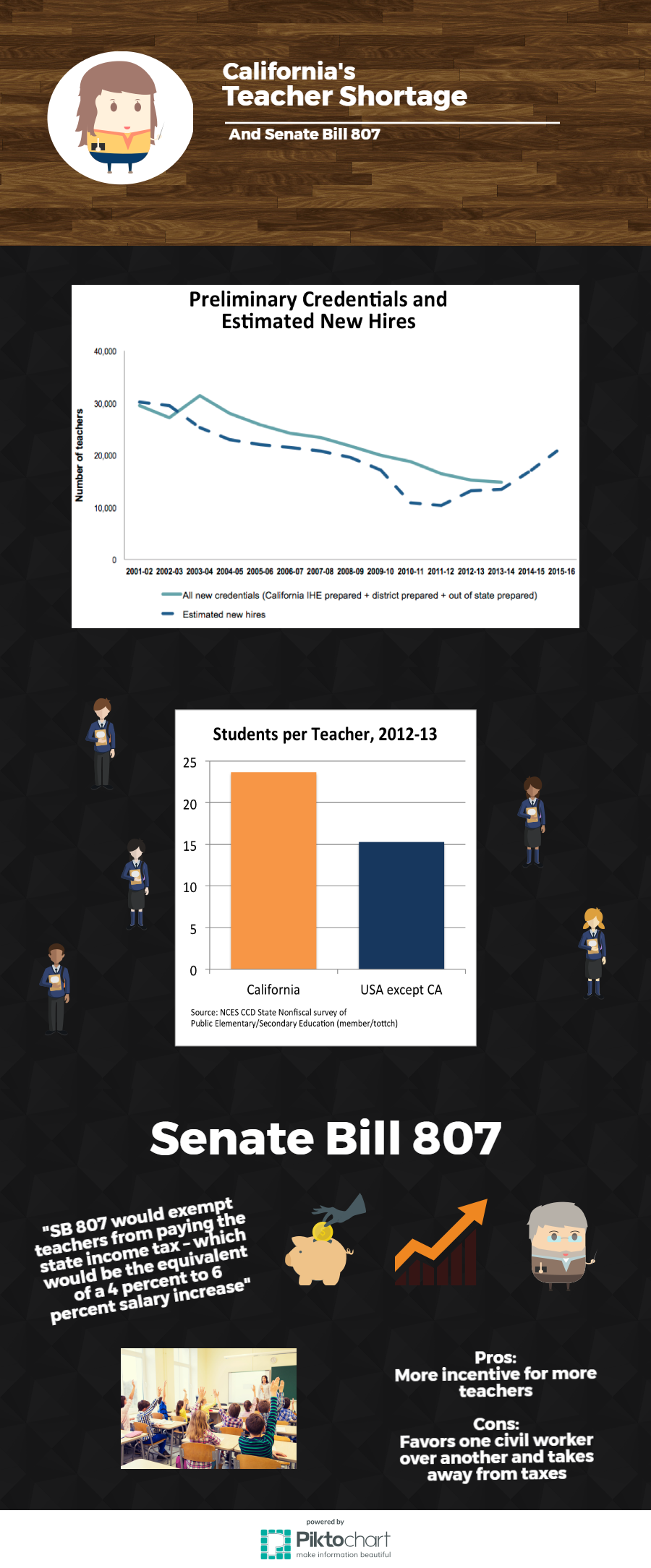

According to data compiled by the California Commission on Teacher Credentialing, currently 75 percent of all California school districts face a teacher shortage, and researchers say that one-third of all teachers in the state are older than 50. This is because the teacher turnover rate remains high while fewer people are entering the profession.

In the 2014-2015 school year, enrollment in teacher preparation programs was 40 percent lower than the 2010-2011 level and 73 percent lower than the 2001-2002 level.

“The cost of living in California, especially in the Bay Area, is much higher than many other parts of the country. You’re not gonna be able to function well in the Bay Area off of let’s say $50,000 a year,” said Ting Sun, co-founder and the executive director of the Sacramento-based Natomas Charter School.

The goal of the bill, officially known as Senate Bill 807 (SB 807), is to retain teachers and provide incentives for more people to become teachers. SB 807 would exempt teachers from paying the state income tax, which would be the equivalent of a 4 to 6 percent salary increase. Teachers would have to stay on the job for five years to qualify.

“I think it would change things dramatically,” Sun said. “I’d be happy to see more teachers educating our youth.”

SB 807 is being co-sponsored by California Senators Cathleen Galgiani and Henry Stern who say teachers are critical to California’s success.

“Teachers are the original job creators. The teaching profession is critical to California’s economic success and impacts every vocation and profession in the state,” said Stern in a press release. “SB 807 addresses the immediate teacher shortage and sends a loud and clear message across the state and nation: California values teachers. We will help train you and we want you to stay in the classroom.”

However, many conservative groups criticize the bill. The Howard Jarvis Taxpayers Association is one of the bill’s opponents.

Jazz Shaw, who writes for the association’s site, wrote, “If you take an entire class of people based on their occupation and say that they are somehow ‘more deserving’ than everyone else and should be exempted from paying state income taxes, what other groups might qualify? It’s not hard to imagine quite a few of these ‘deserving’ professions being rather quick to have their hands out.”

Nevertheless, the bill is expected to go through committee review by the end of the month and has not yet faced any opposition from lawmakers. It is unclear, however, what the estimated state loss in tax revenue would be if the bill were approved.

According to a press conference conducted by Fox News, the California Teacher Association has so far not taken a stance on SB 807 but agrees that the shortage of educators in the state is a serious problem.