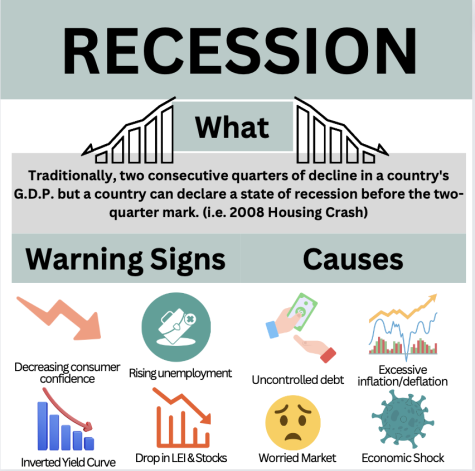

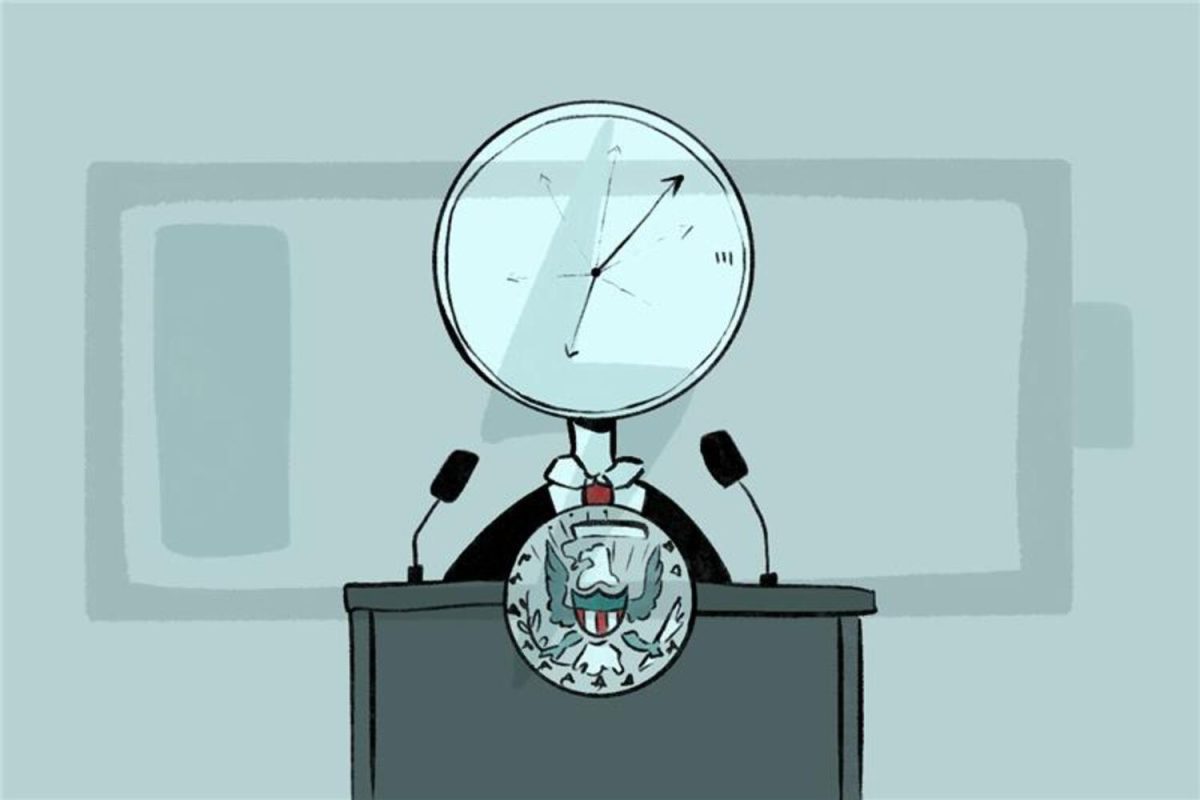

Following the recent British recession, some Americans fear that economic calamity may fall upon the United States in the midst of a global war, international conflict, and rising inflation rates. The endless obstacles facing the U.S. government give sight to the predictions that the coming fiscal year will be an exceptionally difficult one for America.

Joe Biden’s top economic adviser and director of the White House’s National Economic Council, Brian Deese, said during a White House press briefing, that the U.S. economy had the “strength and resilience” to avoid a recession. The Biden administration has brushed off growing concerns about unprecedented inflation rates.

The Biden administration has firmly advertised their opinion that the U.S. will experience a shift to slower growth rather than a deep contraction — thus, experiencing a decline in job growth instead of massive waves of layoffs and unemployment.

“If we look at where the United States are, two things are clear. One is that we have a degree of strength and resilience in the labor market and household balance sheets and in business investment. That is continuing to move our economy forward, and that’s really important,” Deese said. “The second is that we are in a stronger position than … frankly, any other country to navigate through this transition without having to give up those gains.”

British Recession Explained

The UK was already dealing with stagnant wages, global inflation, and an unusually slow economic recovery from the COVID-19 pandemic. It seemed that a recession was inevitable, but former-prime minister, Liz Truss’ “mini-budget” exacerbated the crisis.

The new budget plan introduced tax cuts directed towards Britain’s elite, eliminating the 45% income tax bracket on earnings more than 150,000 pounds. Now, the highest tax bracket is 40%, on incomes over 50,000 pounds. A report by the Guardian estimated that the new taxation policy would save the wealthiest households approximately 9,000 pounds per year. Coupled with the reversal of the 25% corporate tax rate, Truss’ economic policies further alarmed investors.

While the typical solution to controlling an inflated economy is to limit people’s spending, both the tax cuts and the spending Truss proposed made inflation worse because it pushed money out to people and businesses. Thus, with more money available to them, people bought more, consequently increasing demand, which further pushed prices up and scared investors.

Liz Truss’ resignation on Oct. 20, 2022, after 45 days in office, brought increasing uncertainty and panic, leaving Rishi Sunak, the former finance minister, to become the fourth prime minister to inherit Britain’s ongoing economic crisis.

Despite the uncertainty surrounding Britain’s political and economic situation, it seems that Sunak’s victory has brought the U.K. some relief. According to Reuters, Sunak’s victory restores a significant amount of credibility around Britain’s policy and assuages the fears of some investors.

Following Sunak’s entry into office, BlackRock, the world’s largest asset manager, on Monday said “perceptions of fiscal credibility had improved, though not fully.”

Will there be an American recession?

As of now, the U.S. labor market remains strong and experts are divided on whether or not a recession is inevitable in the coming year.

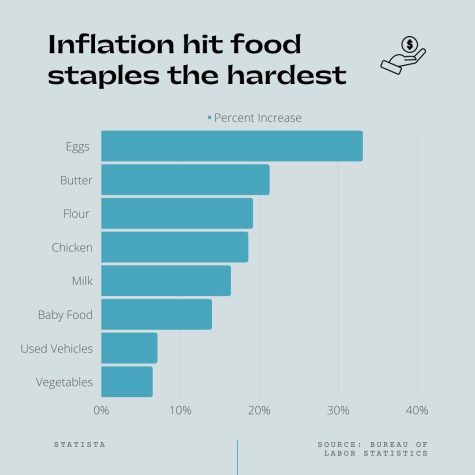

Nevertheless, some Americans are preparing for a recession as supply chain disruptions in Asia, and economic sanctions against Russian oil and gas have exacerbated America’s ongoing inflation crisis that began in 2021.

The U.S. Bureau of Economic Analysis (BEA) recently reported the Personal Consumption Expenditures (PCE) price index rose 6.3% year-over-year in July. Core PCE — the Fed’s preferred measure of U.S. inflation — was up 4.6% from a year ago. While core PCE growth is down marginally from peak levels of 5.3% in the beginning of the year, it remains near multi-decade highs last seen in the 1980s.

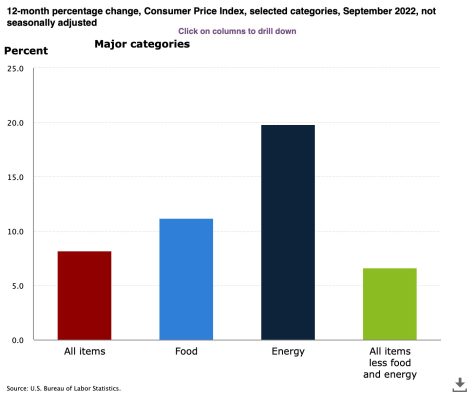

The Bureau of Labor Statistics reported in September that the consumer price index (CPI), a measure of the cost of living, soared by nearly 9% from last year as prices of goods rose tremendously.

In response to the inflation crisis, the Federal Reserve has raised the federal funds rate significantly from 2.3% in September to 3.25%.

“With inflation remaining stubbornly high, the Fed had to implement yet another hawkish pivot by raising rates another 75 basis points and signaling to markets that additional increases in rates are appropriate to bring down inflation,” said Charlie Ripley, senior investment strategist at Allianz Investment Management.

Typically, with the rise of interest rates, it becomes more expensive for U.S. companies to acquire loans to invest in innovation and growth. The rising interest rates also impact everyday Americans by consequently rising credit card, mortgage, auto loan and other interest rates, thus reducing the disposable income Americans have to spend on the economy and further weighing down on corporate earnings and stock prices.

In early July, the yield on two-year U.S. Treasury notes jumped above the yields on 10-year Treasury notes, a phenomenon known as a yield curve inversion.

Inverted yield curves have historically been a strong indicator of economic recession. According to the Financial Times, two-thirds of the time, the U.S. economy has historically fallen into a recession within 18 months of a yield curve inversion. The current yield curve inversion has been the deepest since 2007, the year before the notorious housing crash of 2008.

International obstacles: Russia-Ukraine conflict

Expectedly, the ongoing Russia-Ukraine conflict will continue to have a great impact on the U.S. economy.

Earlier this month, Saudi Arabia and Russia steered a group of oil-producing countries in voting to slash oil production by approximately two million barrels per day.

Currently, the Biden administration is bracing for another potential fuel price surge in December, if a European embargo on Russian oil goes into effect and the Saudi government refuses to increase oil production to make up for the anticipated reduction in supply.

“While we clearly disagreed with the Organization of the Petroleum Exporting Countries Plus (OPEC+) decision in early October, we recognize the importance of continuing to work and communicate with Saudi Arabia and other producers to ensure a stable and fair global energy market,” said Amos Hochstein, Biden’s energy envoy during a White House press briefing.

While the situation in Saudi Arabia has certainly been a pushback for the United States, the U.S. is still trying to reinstate ties with the Saudi government in an attempt to salvage a trade deal before the midterm elections. The lack of foresight on the Biden administration’s part might reflect negatively during the elections, as most Republicans have capitalized on the opportunity to prove that Biden and the Democratic party have failed to achieve favorable economic conditions and have further worsened the United States’ international relations.

Furthermore, the new Russian military draft has caused more international and economic chaos. Vladimir Putin’s draft has signaled that Russia no longer has an upper hand in the Russia-Ukraine war and is resorting to drafting citizens as a last-ditch attempt to gain control over the situation.

Putin has repeatedly threatened nuclear conflict and considering his depleted military resources, paired with internal dissent, it is possible that Putin may resort to going through with his outrageous claims about nuclear war.

Putin has already launched multiple missile attacks on Ukraine and may continue to do so in the future. While Putin has previously suspended missile attacks because of his depleting middle resources, it seems that Russia has found a friend in Iran, as Iran has decided to support Russia in the conflict by providing missiles and drones in aid.

While the U.S. is preparing for a nuclear conflict, the war in Russia and Ukraine has impacted the American economy and will continue to do so throughout 2023 as well. According to the World Bank, the price of crude oil is expected to average approximately $92 per barrel in 2023 — falling well above the five-year average of $60 per barrel. The report also estimates that energy prices will remain 75% above their five-year average.

Wheat prices in the third quarter of 2022 fell nearly 20% but remained 25% higher than the previous year. It has been predicted, however, with Putin throwing constant blows at Ukraine, that agricultural prices will rise temporarily in the coming year.

A new “world currency” and a foreseeable war in Taiwan

To add to America’s lengthy list of economic problems, China and Russia have been stockpiling large amounts of gold at an unprecedented rate for the past couple of months.

This past June, Putin announced the development of a new gold-backed international reserve currency with other BRICS countries (Brazil, Russia, India, China, and South Africa).

According to Business Insider, if a new global, metal-backed currency is achieved, it could possibly dethrone the U.S. dollar. This could expel the U.S. as the economic leader of the world.

On Oct. 16, China held its twentieth party congress conference in which Xi Jin Ping declared that Hong Kong is now under the “full control” of China and that Taiwan would be next.

“To put it simply, Biden has forced all Americans working in China to pick between quitting their jobs and losing American citizenship,” said Jordan Schneider, the senior analyst at Rhodium Group, in a tweet. “Every American executive and engineer working in China’s semiconductor manufacturing industry resigned yesterday, paralyzing Chinese manufacturing overnight.”

China’s chip manufacturing industry powers everything from cars, phones, and household appliances to clean energy and military systems.

Because Taiwan produces the world’s majority of semiconductors, if and when China decides to restore its chip manufacturing dominance, they’ll be fully prepared to launch an invasion on Taiwan, thus immediately forcing the U.S. into war.

The ball is now in China’s court and the world will nervously be watching. The U.S. cannot afford a war on multiple fronts right now. With loosening relations in the Middle East, the threat of a war against China hanging over its head, an ongoing conflict with Russia, and a worsening economic crisis, the U.S. will definitely face difficulties in the coming year.

With such political and economic uncertainty, it is vital for Americans to carefully follow international news and foreign policy and prepare for the hardships the country will face in the next fiscal year.

2023 will be a test of American hegemonic power, and this time, it might be too late to come out on top.

P. Pena-Smart • Nov 25, 2022 at 8:10 am

very interesting article…Americans better quit worrying about what gender you are and start demanding and controlling OUR government from plunging us into an war,depression and financial ruin. The Biden administration increasingly leaning towards communism, feeling that china would keep Joe Biden as ruler of the Americas. However I think China would rid themselves of The Biden’s first. In 2024 we should also rid the White house of this corruption in a free and fair every vote counted with out dead people voting and ballot box stuffed. Americans have become doomed by history of a soft nation, we must harden ourselves quickly and match the fight sword for sword, or lose OUR great free nation..

Sahana Patel • Nov 16, 2022 at 3:41 pm

This is so awesome!

Sophia Sunbury • Nov 7, 2022 at 2:27 pm

Amazing work as always Jasneh!!!