As students graduate from high school and enter adulthood, the challenges of becoming increasingly independent and managing their own lives are spread before them.

Regrettably, many students are ill-prepared to face these challenges independently, as our educational system often overlooks the teaching of vital life skills.

The absence of financial literacy, for instance, is evident in the fact that only 25 states ensure some form of personal finance education before graduation. Similarly, home economics classes have become a rarity in curricula, meaning that students do not have the opportunity to learn and develop these essential skills in high school.

In adulthood, financial literacy can significantly influence the direction of one’s life. The lack of this knowledge and skills can lead to financial chaos, with mistakes that can haunt individuals for years, impacting their quality of life and future prospects.

However, through financial literacy classes, students can be exposed to money concepts earlier, which allows them to learn and make mistakes when the stakes are much lower.

Despite the serious consequences and subsequent importance of financial literacy education, according to Empower’s Money Talks research, over 60% of Americans never learned about money in school. Given the numerous benefits of financial literacy education, it is concerning that most Americans have not learned about these skills.

Furthermore, the California Department of Education has stated that research reveals a compelling correlation: students with access to high-quality financial education tend to have better economic outcomes as adults, resulting in less debt and a higher quality of life. This correlation underscores the significant societal impact that financial literacy education can have, as it contributes to a more financially stable and prosperous community.

Additionally, this can be further demonstrated by a study from the FINRA Investor Education Foundation, which found that 70% of respondents with higher financial literacy had some type of retirement account. In comparison, only 43% of respondents with lower financial literacy had one. The same study also found that those with higher financial literacy were more likely than those with lower financial literacy to spend less than their income, set aside three months’ worth of emergency funds, and try to figure out retirement savings needs.

The skills taught in financial literacy can also immediately be applied to life as they help people manage their finances when moving out, when living on a budget in college, or even when working with student loans.

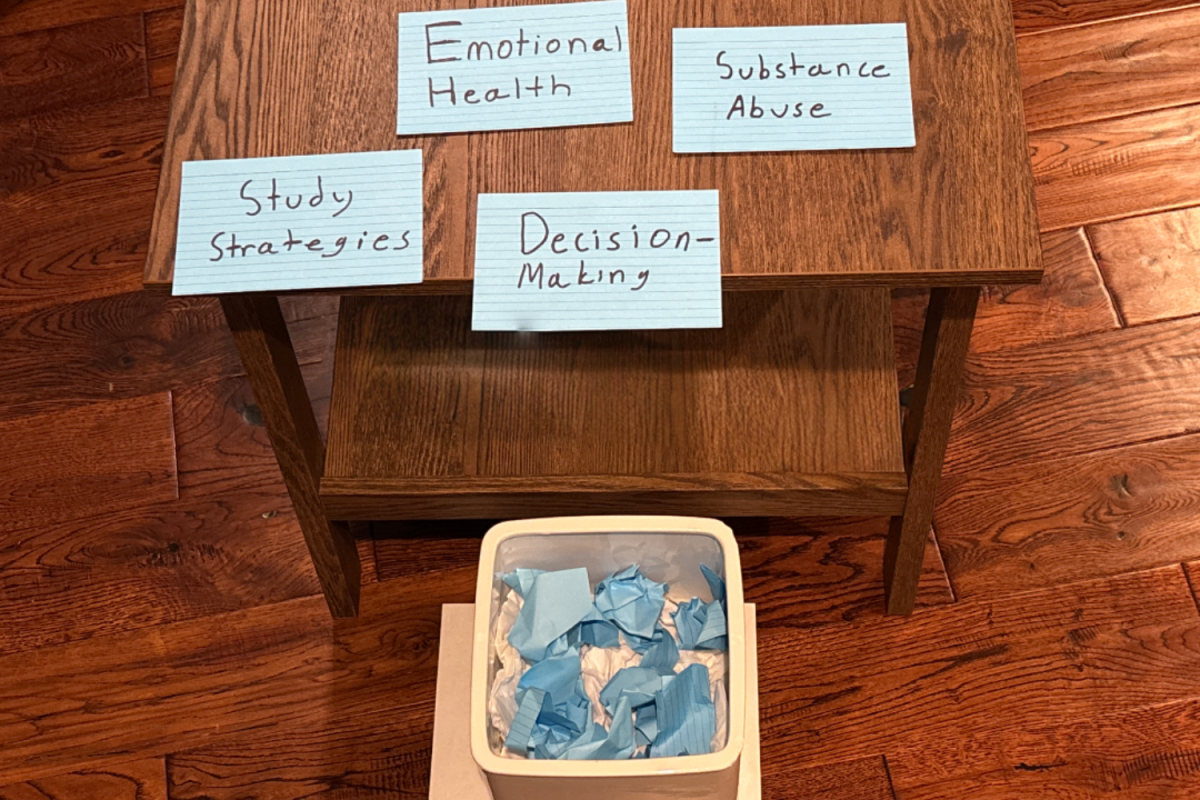

In addition to the failure to teach financial literacy to students, students are not sufficiently prepared for career or major selection in college as they do not receive many opportunities to explore the options available.

“In truth, very few students have all the information they need to choose a major when they finish high school,” said Joanna Brooks, associate vice president for faculty advancement and student success at San Diego State University in U.S. News.

When students reach college, 51% are confident in their career path when they enroll in college, and just over half of them will change their major at least once. These statistics are worrying as, according to Ellucian, they can cause students to take additional courses, delay their graduation, or increase their college tuition.

Students will have to spend more time and money in college to figure out what they want to pursue, even though increased career exploration during one’s high school education could have provided them with a more in-depth understanding of their aspirations.

Overall, classes for financial literacy and increased opportunities for career exploration are just two of the many solutions schools can utilize to prepare students better and mitigate the potential for students lacking essential skills for adulthood.