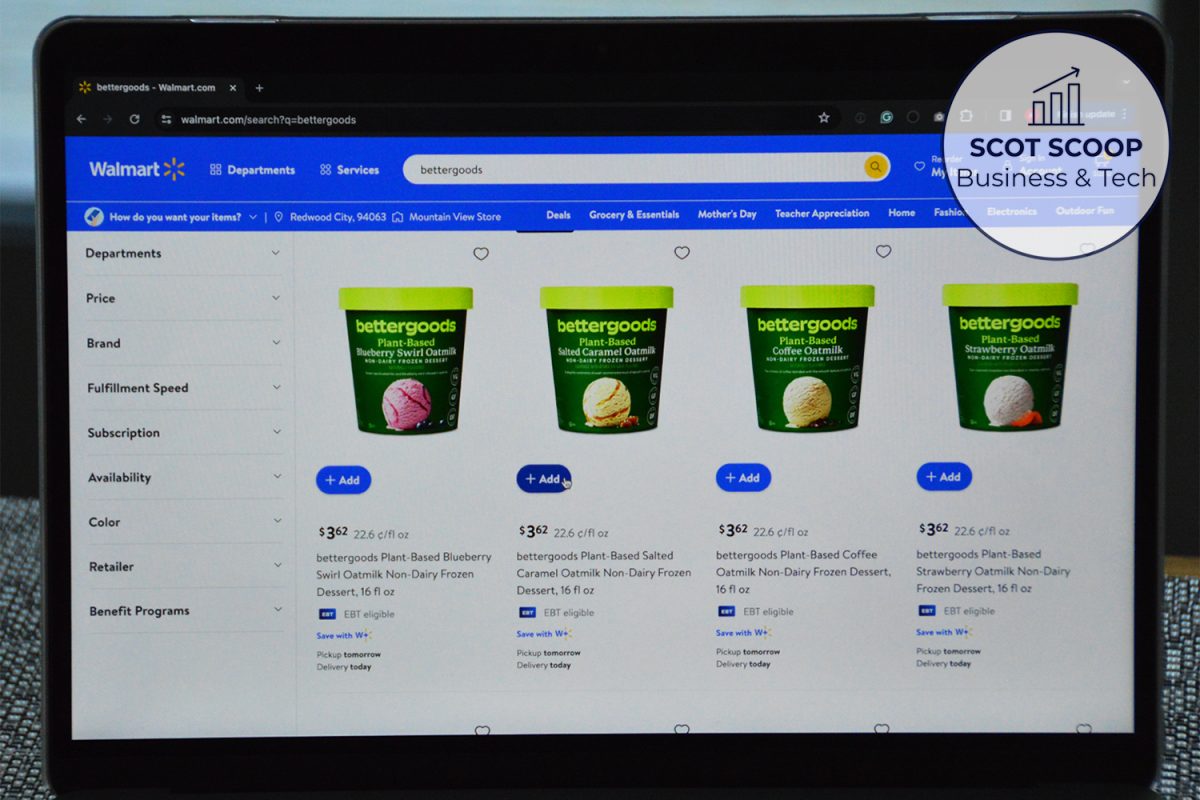

Shrinkflation is the practice of reducing the size of a product while maintaining its price. When products shrink and prices don’t change, it causes inflation because the per-unit prices are increasing.

For example, if your favorite drink company reduces the size of its bottles and maintains the prices, you will be paying the same for less. So, by raising the price per given amount, companies can boost profit margins (revenue minus all costs) or maintain them even while input costs are rising.

Inflation is the rate at which prices for goods and services rise. According to the Bureau of Labor Statistics, from 2019 to 2023, shrinkage added about 3.6 percentage points to inflation for products like paper towels and toilet paper and 2.6 percentage points for snacks. In simple terms, for a product like paper towels, which increased in price by about 32%, the actual price increase was 35.6% when accounting for the reduced package size.

Official inflation data is able to account for shrinkage, but “skimpflation” is another subtle factor which also impacts consumers. Skimpflation, which occurs when companies increase profit margins by using cheaper materials or ingredients to save on costs, is often overlooked because it’s difficult for the government to measure.

For example, if you buy cereal that is the same size as normal but made of cheaper ingredients, the government won’t record this as inflation.

Companies often use shrinkflation to combat higher production costs. When the value of raw materials or labor increases in value, the cost of producing finished goods also rises. These increased costs put pressure on profit margins. So, instead of increasing the price of a product, a company will often offer a smaller package for the same sticker price to maintain its profit margins.

Shrinkflation isn’t exactly a perfect solution, though; when companies use shrinkflation, they run the risk of turning customers away from a product or brand if they notice they are getting less for the same price.