While reaching adulthood, often synonymous with graduating high school, comes with new freedoms, it also comes with new responsibilities, especially financially.

Having financial freedom, and freedom in general, is usually seen as a positive, but being in full control of your money comes with many risks. Young adults have to account for paying for necessities, such as food and housing, along with the discretionary niceties or luxuries that they might have splurged on before.

However, managing these funds is a big deal, and many younger adults fall into traps at a young age, leading to massive debts. Especially for those who accumulate thousands of dollars in loans or debts early on, repaying these costs will take years and years of effort.

According to a study by Experian, the average Generation Z adult, from 18 to 24 years of age, had $20,803 of debt in 2021. Even more drastically, the average Millennial, from 25 to 40 years old, had over $100,000 in debt.

This $20,000 turns into $100,000 within a decade partly due to recklessness regarding money management. A lack of familiarity with money management during high school, due to not having job experience, is a reason why young adults fail to manage their finances properly.

Only around 30% of high schoolers in 2020 had a job, whether that be year-round or during the summer. A reason for this lack of job experience for most teens is that they can count on their parents to purchase both their necessities and non-essential goods; therefore, working is a waste of time.

However, by relying on parents, high schoolers lose out on the opportunity to manage their own finances when there are lower stakes. By working during high school, teens learn to regulate their spending habits, mirroring skills needed in adulthood.

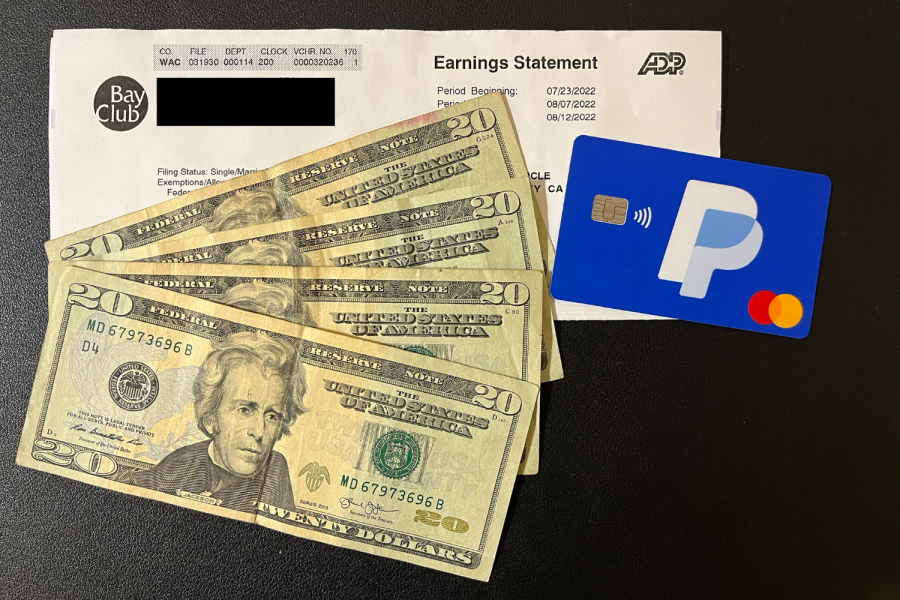

Additionally, many young adults use credit cards without understanding the associated risks. Inexperienced consumers fall victim to the intricacies of credit card policies, where companies allow people to borrow large sums of money but then charge heavy interest rates after the money isn’t returned in a timely manner.

As the average credit card interest rate has risen to over 19%, per a survey conducted by Bankrate, it is imperative that we understand the impact of credit card debt on our future.

Another cause for debt to accumulate is living paycheck to paycheck during the first years of adulthood. Relying on one paycheck to cover two weeks of spending can prove costly, especially if unforeseen circumstances occur.

These are just two of the numerous financial pitfalls young adults face after high school graduation because they hadn’t been aware of them. Taking a personal finance class in high school, which prepares students for financial freedom and teaches proper money management, is a way to avoid falling for these pitfalls.

Personal finance courses are not popular among students because they are seen by many as a waste of a course, particularly for those seeking a high GPA. However, this narrow-minded view reflects how many teens later crumble under an avalanche of debt in college. In reality, these classes are key to understanding how to manage money wisely and recognize financial risks, two qualities many young adults struggle with.

While falling into some debt is practically inevitable during adulthood, we can overcome the financial unpreparedness of many young adults by working during high school or gaining awareness through a personal finance class.

*This editorial reflects the views of the Scot Scoop Editorial Board and was written by Myles Hu. The Editorial Board voted 6 in agreement, 3 somewhat in agreement, and 3 refrained from voting.