After banning Australian coal imports last year, China is facing one of its worst power crunches.

After Australia announced an investigation on the origins of COVID-19 last year, China placed an informal ban on many of its Australian imports.

Initially, Australia struggled with losing one of its largest consumer bases, but the country didn’t suffer too long. Due to the skyrocketing expenses of clean energy, nations like Japan, India, and the Koreas have been looking for cheap substitutes, like coal.

China, on the other hand, initially remained unaffected by this decision. Being the world’s largest producer of coal itself, China had sufficient stocks. However, in early October, China’s largest coal-producing region, the Shanxi province, was hit by severe flooding, which washed away much of its reserves.

“China doesn’t have coal reserves to produce energy for the next 14 to 15 months. They are starting to look to their neighbors for the resources they need,” said Inderpreet Walia, a senior markets reporter for Lloyd’s List.

With the floods causing power outages, not just in Shanxi but across the country, China has turned to Indonesia, Mongolia, and the U.S. as new coal suppliers.

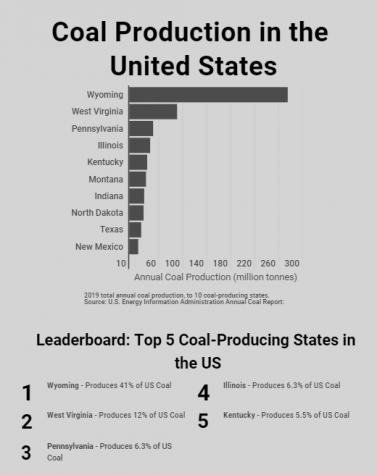

Due to the cost of coal in other countries, the United States appears to be China’s best option. Trade between the countries won’t only benefit China, but the U.S. too.

“America’s coal industry is dying … the trade of coal will at least temporarily revive the industry. This is something to look forward to for the American people living in coal states like Wyoming and West Virginia,” said Ken Silverstein, a West Virginian senior contributor and energy writer for Forbes.

Trade with China could not only reopen the coal industry in America, but it could revive other industries as well. Companies ranging from Starbucks to Apple could advance in China, and Chinese companies could reach the American market.

“Hopefully, the new trade will bring the U.S. and China to realize that while they are competitors, they need each other to survive. It is possible that China may also start increasing trade with the U.S. and will remove tariffs. It would be beneficial for both the United States and China to increase trade with each other,” Silverstein said.

However, it’s possible that China won’t be able to rely on the U.S. forever.

American coal is more expensive than Australia’s, which won’t be the most efficient or cost-effective solution for China in the long run.

“While China can temporarily buy coal from the U.S. or its neighboring Asian countries, it wouldn’t be in their best interest to do so. At some point, they will have to return to Australia,” Walia said.

Despite the dire situation, it is doubtful that this will be the end of the still-rising superpower.

“The Chinese economy will be hurt by this decision. It will certainly get worse before it gets better, but this will not be the end of China … Most likely, China will bounce back by next fall,” Silverstein said.

It is becoming increasingly obvious that China controls the global supply and manufacturing chains. Virtually everything today is made in China, ranging from small gizmos and toys to gadgets and clothes.

“It is important to understand that not only does China need the coal that is currently stationed at their ports, but that this is a humanitarian crisis. Australian workers have been stuck with little to no food, away from their families, in coal ships for over a year now. If China releases the remaining coal, they may be able to ease their current power crisis as well as send the workers back to their country,” Walia said.

However, China’s control could indicate a shift for the United States.

As the holiday season nears, shoppers are ready for Black Friday and Wintertime sales. Post-pandemic, shoppers are ready to leave their houses and hit the malls with friends and family. Unfortunately, due to the power crunch, China may not be able to produce products consumers want.

“Factories are closing down, which means that we may not see gadgets, clothes, or other products coming out of China this year. I think it would be fair to expect that either the cost of said products will rise or that consumers will have to wait a while for their shipments,” said Miguel Licudine, a sophomore at Carlmont.

The effects of this power crunch are already starting to show. Apple declared that the distribution and manufacturing of the iPhone 13 and other new Apple instruments have slowed down this year due to the slow manufacturing of screens and other parts in China.

Additionally, the power crunch has only further exaggerated China’s semiconductor shortage. These semiconductor chips are used to power almost all technology, ranging from computers and phones to toasters and coffee machines.

Some appliances will be limited in stores, and other products will likely rise in price.

“Prices will rise for a lot of things this year, but within a few months, it’ll go back to normal. The rise in expenses will be temporary,” Silverstein said.

While this year’s Christmas may need to contain many DIY gifts, the next holiday season will hopefully be back to normal.