This year, roughly 4 million Americans turn 18.

They will be free to become their own person, chase their dreams, and start their lives.

But will they get the chance?

Going out into the world and successfully paying for school, renting or buying a home, making long-term investments, and saving up for retirement takes a certain amount of financial knowledge that not many Americans possess.

According to a FINRA Investor Education Foundation study, there is a clear trend of declining financial literacy. On average, four in five young Americans failed to answer a majority of financial literacy questions correctly when asked.

Although scarce among the American population, financial literacy is a key concept necessary for life within a capitalist society.

Over the past decade, the Millennial and Gen Z generations have been introduced into a digital realm, where money is often exchanged through a virtual transaction. With the institution of online banking programs and other services like PayPal and Venmo, the younger generation must hurdle yet another series of difficulties before becoming financially independent.

Student loans — another area where financial literacy would be a helpful tool — have seen a steady increase in recent years. In 2020, student debt reached a record high of $1.56 trillion, with 54% of millennial students concerned about their financial situation in higher education.

Truly feeling comfortable within an adult environment should be a common goal for high school and college students, but it is quite challenging to achieve without proper education. Regrettably, as of 2020, only 21 states mandate the teaching of finances within high schools.

California is not among them.

This seems rather strange. Considering the role of the economy in our lives and the necessity of filing taxes and paying for insurance, shouldn’t there be more concern over this issue?

Too often, I have found myself at the doctor’s or the dentist’s office, overhearing my parents discussing their insurance coverage and appointment costs.

Too often, I stand awkwardly to the side, occasionally signing a form filled with minuscule legal details, without knowing what I agreed to: wondering when I should start learning how to do this myself and where to start.

However, despite the numerous statistics that point towards the crucial need for financial education within learning environments, many critics question the need for schools to provide free programs for students.

They believe that teaching financial literacy in schools can lead to overconfidence and a less than adequate coverage of all the necessary material, or that it is the responsibility of the parents to teach their children how to be money-smart.

Regarding the issue of inadequate coverage, it is simple enough to weigh the pros and cons; in any case, it is better to have an incomplete understanding than no understanding at all.

When looking at the idea of homeschooling, however, it may be easier to compare why financial education should be taught and prioritized at schools.

Imagine a kindergarten classroom. The children, sitting in a group in the center of the room, are surrounded by letters, words, and numbers of all shapes and sizes. Some represent animals, some represent colors, and others symbolize diverse places around the globe.

However, these kindergarteners cannot read. Or, more accurately, they have a basic understanding that letters make up words, words stand for objects, and that sentences can be formed from a combination of these words. But they can’t make out which is which on the page.

They hear these words all the time, and they know what they sound like.

But they don’t know how to read.

Satisfied that the children understand her verbal instructions and lessons, the teacher never bothers to teach them how to read words. Thus, the kindergarteners move on with their lives, talking, hearing, listening, and understanding the English language but unable to write and read it.

Financial education is the same. Many 18-year-olds know that finances exist and the basics of how the system works but struggle with how to apply it to the real world.

Although some parents do have the opportunity and energy to pass on their financial knowledge to their children, they often don’t have a great understanding of it. On the flip side, even if they are literate, they may not always have the time to teach everything that goes into being able to survive financially.

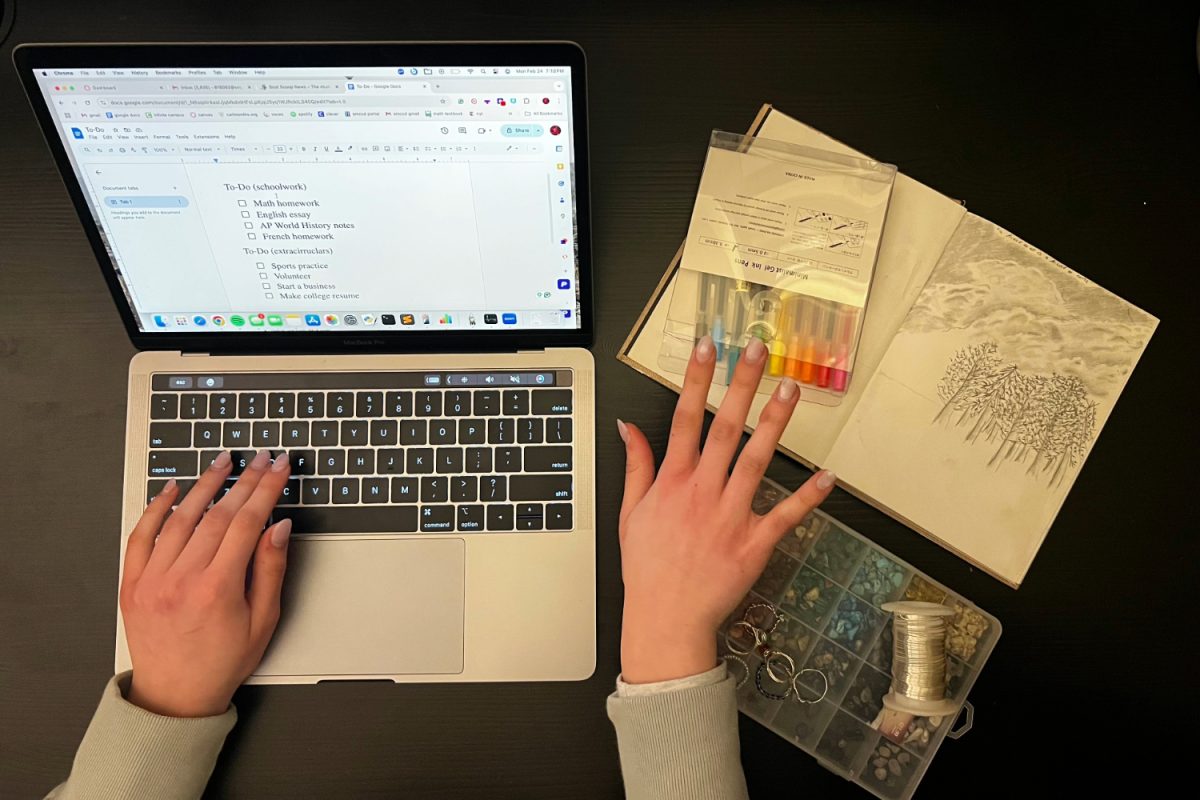

That is why high school students need to be given the opportunity to learn for themselves how to set up a bank account, use a credit card, file tax returns, etc.

It doesn’t have to be an intricate, well-funded program. It can simply be a personal, online course that can be finished at one’s own pace.

But, at the very least, it should be available at all schools and promoted across the country to ensure a more money-smart generation.