For the foreseeable future, climate change will be the end of humankind and life on Earth.

People can already see the many devastating effects of climate change. Melting glaciers, drought, and rising sea levels will only worsen if nothing is done to stop this phenomenon.

Many people have become aware of climate change and the potential consequences, including United States President Joe Biden. He has put out various solutions in an elaborate plan, but it is unlikely that he will implement the carbon tax, according to Axios. The carbon tax is one of the more economically viable solutions to stop climate change and carbon emissions.

The Center on Global Energy Policy at Columbia SIPA defines a carbon tax as a set price for a certain amount of each greenhouse gas emitted into the atmosphere. For example, companies would have to pay $15 per ton of carbon put into the air. A report by the U.S. Energy Information Administration states that the United States emitted 5.1 billion tons of carbon. Multiply each ton of carbon by $15, and the result is 76.5 billion dollars of extra budget money.

Having to pay money for greenhouse emissions would greatly discourage companies from continuing to pump pollutants into the air. It also gives the United States a bigger budget for fighting climate change or allocating money wherever needed.

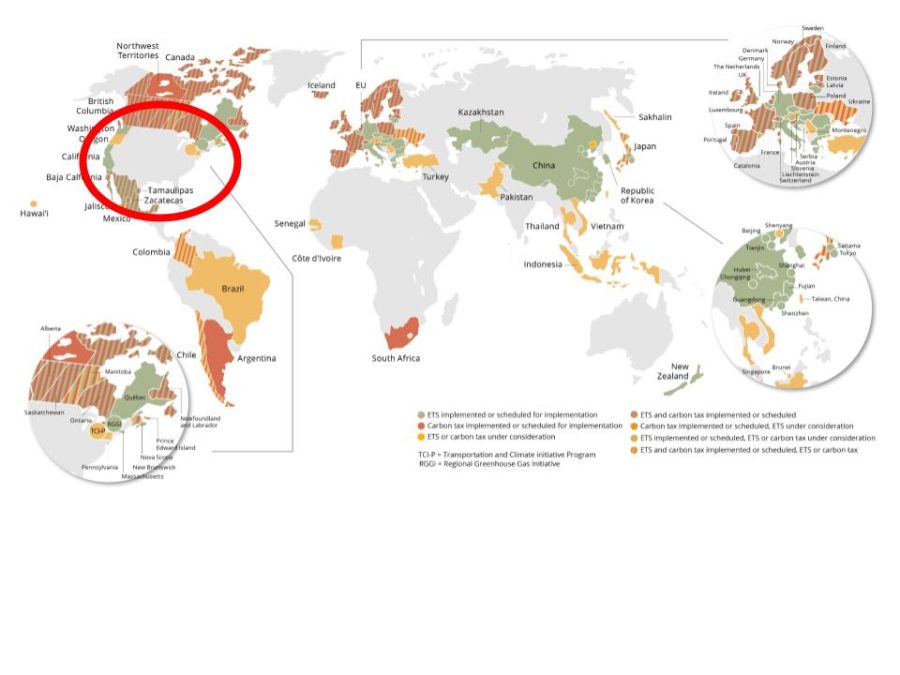

Other countries worldwide have already implemented a carbon tax, and it has proven to be highly effective in these countries. According to the U.S Energy Information Administration, coal consumption rapidly decreased when the carbon tax was introduced in the United Kingdom. Coal consumption went from 42% to 7% in a matter of five years after the carbon tax was introduced. As a result, utilities switched to natural gas and renewable energy.

Canada’s carbon tax allows Canada to tax almost every kind of pollutant for about $40 per ton. As a result of this carbon tax, Canada has been able to redistribute the money back into the economy and reduce the taxes for Canadian citizens. The tax allows Canada to outperform the United States and other lacking countries in carbon emissions and simultaneously boost the economy.

An editorial by the Investor’s Business Daily advocated against the carbon tax, saying it leads to economic detriment and that the cons outweigh the benefits. The article states that the carbon tax will raise gasoline prices, hurting the economy because people have to pay far more for their energy. It also states that even though money can be redistributed back into the economy, it will be spent on higher energy prices. As a result, there will be fewer jobs and a downward economic trend.

However, the editorial fails to consider the inevitable shift to cleaner and renewable energy that will not be taxed as heavily or not be taxed at all. The businesses emitting tons of millions of carbon into the atmosphere will have no choice but to pay the price. Even though some businesses will suffer and some jobs will be lost, more jobs will be created elsewhere and businesses will grow centered around renewable energy.

Climate change is one of the most challenging problems that humans have had to face, but using a carbon tax will accelerate the process of eliminating carbon emissions and the transition to more renewable energy.