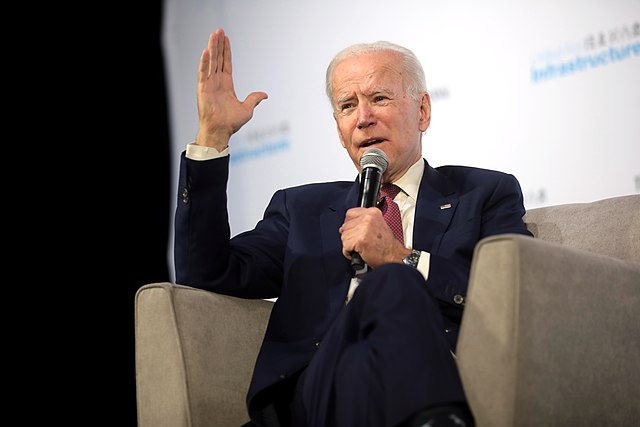

President Joe Biden announced a plan to eliminate up to $20,000 in student loan debt for middle-income families.

According to studentaid.gov, individuals making less than $125,000 and couples making less than $250,000 can receive up to $10,000 in debt compensation.

Students who are Pell Grant recipients and given financial aid to compensate for low income will be able to cancel up to $20,000 worth of student loan debt. Applications are accessible online to anyone who qualifies.

“A lot of folks are even putting off starting families because of the cost. The dreams of starting or owning a business are way off in the distance with a debt that so many are saddled with,” Biden said in an announcement speech.

In addition to relieving borrowers, the plan also intends to introduce more accountability systems for colleges and universities charging higher tuition. The Department of Education will publish an annual report of the schools with the worst debt in the country and request tuition improvements from those schools, according to whitehouse.gov.

“I think it’s a nice starting attempt to help out students with tons of debt,” said John Rowe, a business teacher at Carlmont High School. “Private schools cost $40,000 to $50,000 more annually, and you can easily rack up hundreds of thousands of dollars of student debt, so just allowing people 10 or $20,000 of student debt is a tiny portion of what they owe.”

In recent years, college prices have skyrocketed, meaning students have to take larger loans. As a result, many students have to dedicate years of their lives to pay off debt. According to Pew Research, the COVID-19 pandemic also placed an economic strain on many families, with 9.6 million jobs lost during the pandemic. Combined with inflation, these problems made it harder for students to pay off their debt.

“The problem is that college is too expensive. When I went to Cal Poly San Luis Obispo, it was less than $2,000 a year. Now, even the state schools are $10,000-$20,000, and private schools are $50,000-$60,000,” Rowe said. “The reality is, they’ve shifted the burden of paying for college onto people. Normally, it would be subsidized by the government, but over the years, the government has paid less for college.”

Adam Sundermeyer, a freshman at Embry-Riddle Aeronautical University, thought that helping out with debt was a good idea to fix the loan relief system. However, it would increase the amount of inflation in the economy. According to the Cable News Network (CNN), the national debt for the United States is over 30 trillion. He believes the number will increase with the plan.

“The current loan relief system is nearly non-existent as far as I’m aware and fails to cover the enormous quantity of student loans and the massive cost of college in modern times. The incoming plan will help many students, but I’m concerned about how it could affect inflation and national debt. If 300 million is spent on loan forgiveness, where else could that enormous amount of money have gone?” Sundermeyer said.

Aeon Lem, a freshman at the University of California Berkeley, thought the plan also had good intentions. Still, it didn’t sufficiently address the root issue.

“The debt relief program is a step in the right direction, but by no means a solution to the problem of student loans,” Lem said. The plan doesn’t address the underlying issue: education is so expensive that students often have to sacrifice their standard of living in exchange for a degree.

Lem also claimed that the plan could have the opposite effect of what’s intended.

“Another negative thing about the plan is that it may encourage students to take out more loans because they think another relief plan will happen, negating the plan’s effects,” Lem said.

All in all, the plan will attempt to address the growing problem of student loans, but many believe that Biden needs to do more to address the costs of college tuition itself.

“It’s more of a question: What can we do to make college more affordable to students, especially low-income students? It’s $10,000 for the average American and $20,000 for someone with a low income, but why not go even further?” Rowe said.