Schools in California are chronically underfunded.

As of the 2016 -17 school year, California’s yearly amount spent per student was $2,410 below the national average once adjusted for the cost of labor, and the state overall ranked 41st in percentage of gross state product that goes towards education annually.

Revenue for California public schools is determined using the Local Control Funding Formula (LCFF). This formula determines the base amount that each school district must receive each year. This is determined through a base grant per student in the district, followed by an additional 20% on that base for each student deemed high need (students living in poverty, in the foster care system, or learning English). On top of that, if a district has over 55% of their students classified as high need, all high need students past that 55% threshold receive an additional 50% of funds rather than the additional 20%. For example, if a school district has 63% of its students classified as high needs, the funding is calculated where 37% of the students receive the base grant, 55% receive 120% of the base grant, and 8% receive 150% of the base grant).

The LCFF does not, however, stipulate that the additional funds provided for high needs students must be used on them, meaning that a school district can use the additional funds provided to them because of their high need students on any programs they choose to, not just ones that benefit high need students.

There are two major ways schools can be funded in excess of the LCFF amount — through additional donations or by being a basic aid district.

The way that education funding works in the State of California is a set percentage of property tax revenue must go towards local education; this revenue is used to cover the amount determined by the LCFF, if the local property taxes do not cover the full amount determined by the LCF — the case for about 90% of California School Districts — the state government will step in to fill that gap with state collected income taxes.

As of 2019, 58% of school funding came from the state government, 32% from local sources, and 9% from the federal government. School districts that do not need to rely on the state government to meet the LCFF required funding, known as basic aid districts, get to keep the additional revenue from local taxes allowing for funding that surpasses the amount required by the LCFF.

Most commonly, school districts that are basic aid districts are found in high-income areas because that is where property taxes are the highest. Not only do basic aid districts provide on average more revenue for students, but basic aid districts’ funding is also more stable because the vast majority of state funding for education comes from income taxes, a tax that is much more volatile in terms of revenue generation than property taxes, which is the main source of income for most basic aid districts.

In practice, school districts like the Sequoia Union High School District (SUHSD), the district Carlmont is in, which is a basic aid district, are able to secure vastly more funds per student than the state average. SUHSD, for example, was able to spend $26,781 per student in the 2018 – 19 school year, while the state average that year was only $16,352, a difference of more than $10,000 per pupil.

Schools in high-income areas, like those surrounding Carlmont, in addition to having access to more funds per pupil due to being in a basic aid district, also have access to fundraising from parents that have vastly more resources than schools in lower and middle-income areas.

Fundraising in schools from parents can provide an incredibly large amount of money that goes directly towards providing students with more opportunities.

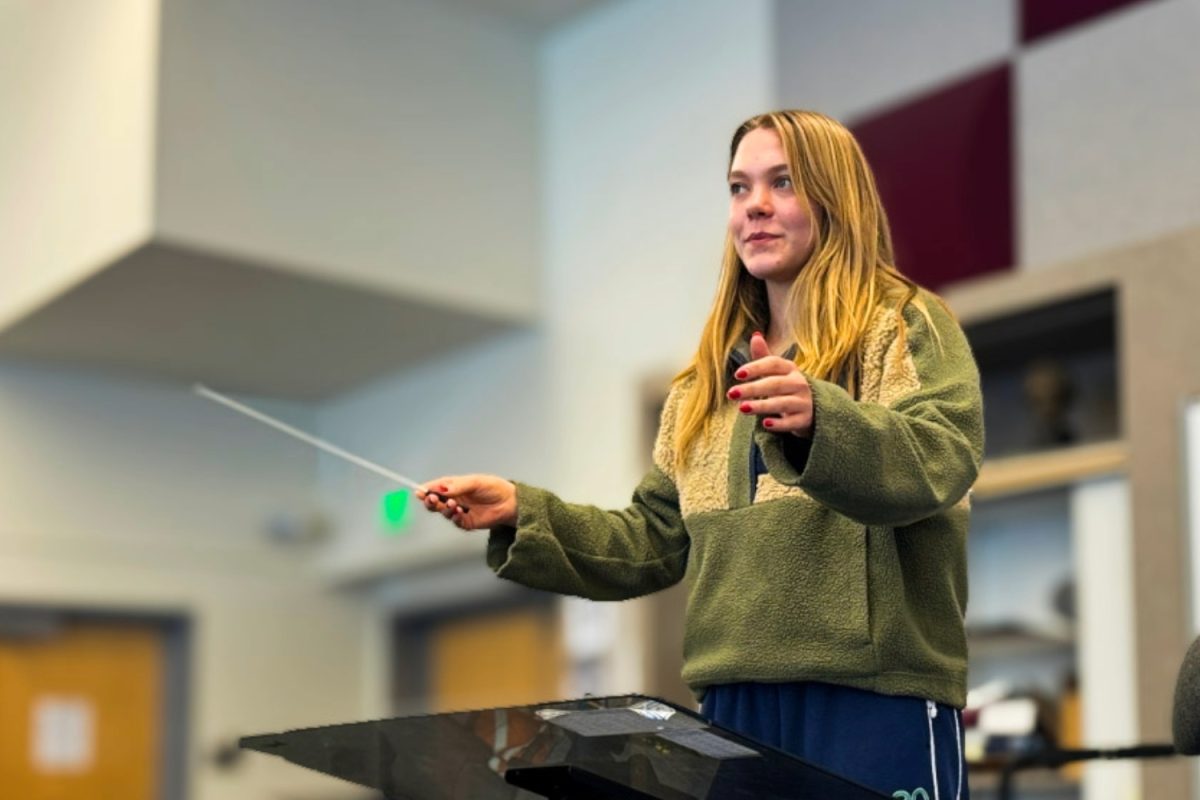

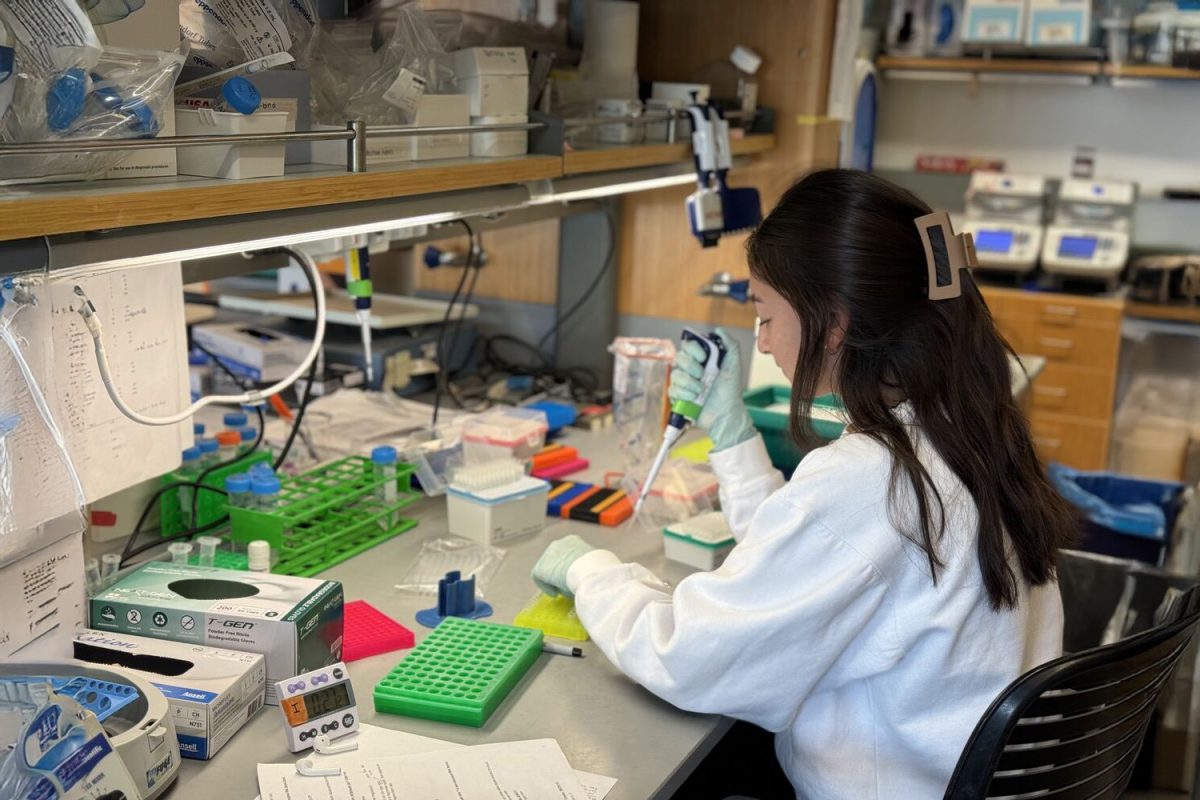

Carlmont is able to pull in roughly one million dollars annually from donations (predominantly from Carlmont’s Academic Foundation, Carlmont Music Boosters, Carlmont’s PTSA, and Carlmont’s Sports Boosters). These additional funds from parents have enabled Carlmont to reduce class sizes, provide testing support, allow for more class options, help fund Carlmont’s Biotechnology Institute, and so much more. The same cannot be said for other schools in low-income areas.

As of now, the California Education system attempts to account for the differences in property taxes through the LCFF; this, however, is simply not enough. Our education system continues to prioritize funding for those from the wealthiest families while punishing those in middle-income and low-income areas by forcing them into a system where their funding is less and determined by the incredibly volatile California income tax.

As a whole, California needs to reform its education system to the point where middle and low-income areas are not spending thousands of dollars less per student annually than the wealthiest areas and in general, needs to increase education funding dramatically across the board.