The death of UnitedHealthcare CEO Brian Thompson has initiated a bigger conversation about healthcare in the U.S. This is not just about one man or a company, but a system that impacts all Americans.

UnitedHealthcare has around 26.6 million customers and 6,700 hospitals nationwide, making it the most prominent healthcare insurance provider. Despite that, many Americans struggle to access the care they need. According to the Pew Research Center, 65% of Americans believe it is the federal government’s responsibility to ensure all Americans have healthcare coverage.

The Affordable Care Act (ACA), enacted in March 2010, primarily aimed to make health insurance more affordable. However, according to the U.S. Bureau of Labor Statistics, the average annual cost of health insurance was $1,560 for single coverage and $6,099.12 for family coverage in March 2023.

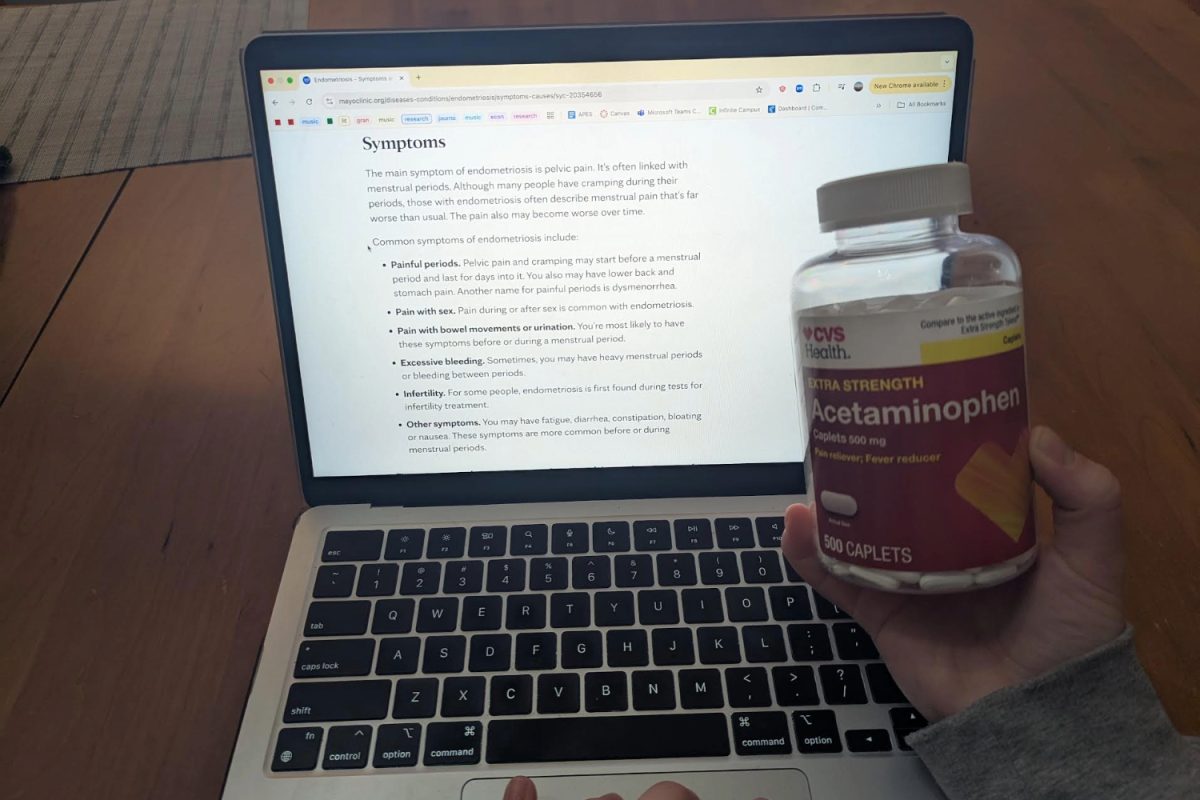

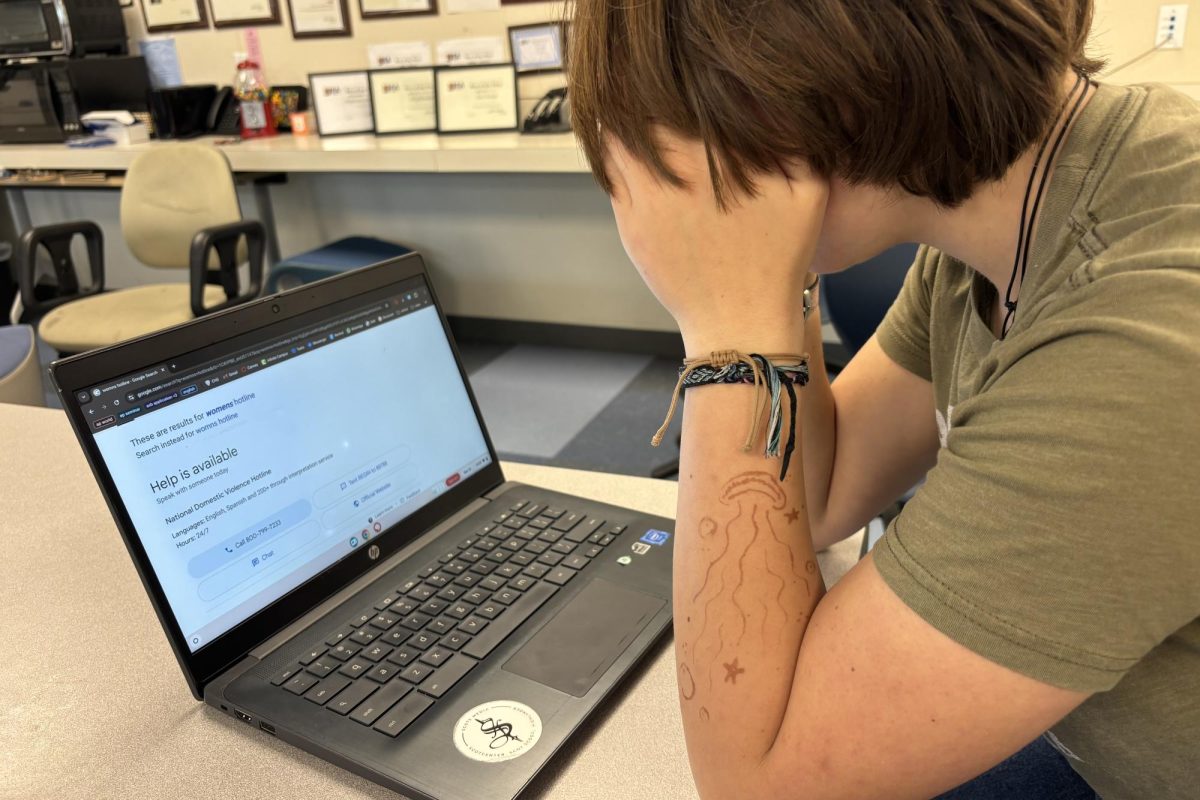

In Nov. 2024, UnitedHealthcare and its subdivision NaviHealth were sued for using artificial intelligence (AI) instead of medical professionals to deny medical claims from elderly patients with a 90% error rate. While AI helps medical professionals deliver better results, using it to restrict access to the care patients need leads to distrust in the healthcare systems, especially those who rely on medication daily. AI is primarily used to increase efficiency and accuracy when diagnosing patients, transcribing medical documents, and developing and discovering drugs, ultimately benefiting patients and customers, not just healthcare companies. The main reason for using AI in healthcare is to help patients rather than leave them helpless, but ineffective AI use further increases the risk of corruption in the healthcare industry.

It is not ethical for companies to profit from a patient’s needs. This rise in prioritizing profit over the patient worsens access to healthcare, deepening system inequalities. It further leads to situations where the patient is only prioritized if they can pay a higher price, which is why 81% of Americans pay a premium for a single medical care coverage, according to a survey in March 2024.

An integrated system combining healthcare and insurance ensures no one is denied care and no one has to pay the premium price.

For example, Kaiser Permanente offers medical care and health insurance, which can effectively lower costs. It is named the best health insurance company of 2024 for affordability and consumer satisfaction.

On the contrary, having an insurance provider differs from medical care, which makes consumers pay more since insurance providers and medical services try to profit from every customer, increasing the overall expense.

Additionally, two companies working together can lead to communication issues or one company overriding the other. Vertical integration can better coordinate patients, doctors, and insurance providers when they are all under the same umbrella, allowing for more efficient processes and lowering costs.

Navigating complex billing systems is also a smooth process. Instead of having two bills with different costs, having one can ensure costs are more transparent for the patient.

By combining insurance and medical care, more patients gain trust in their system, leading to improved health and industry.