Every year, college tuition prices are rising.

According to Make Lemonade, a site that helps with financial aid, there are 44 million borrowers in the United States who have college debt from these large fees.

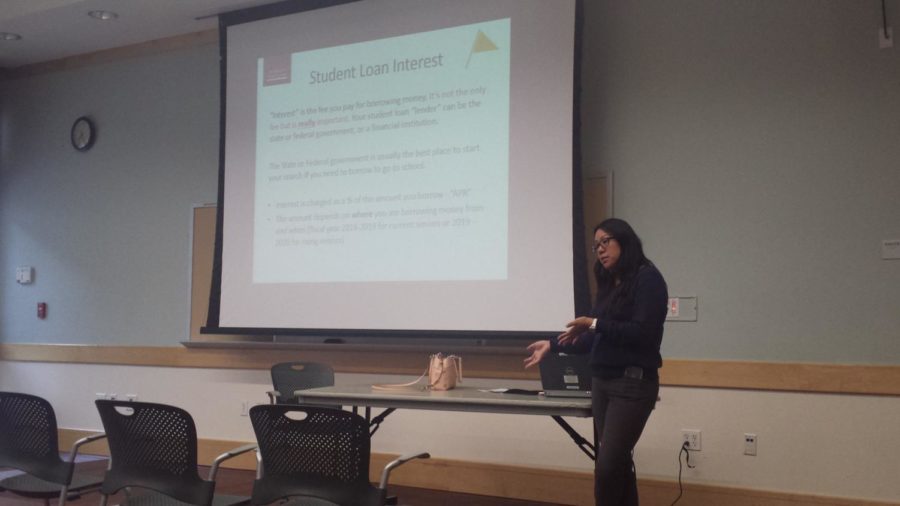

In light of these tuition issues, Kristi Longoria, a Financial Education Administrator with the San Mateo Credit Union, led a workshop at the Belmont Library to educate both parents and students on how they can handle college expenses.

“Applying for financial aid gets access to federal government, state government, college, and private company grants,” Longoria said. “[Students] need to make wise financial decisions so that in addition to loans and scholarships, they know how much work by themselves they need to put in.”

At the workshop, Longoria noted the importance of applying for the Free Application for Federal Student Aid (FAFSA), which allows for students to gain many of the federal/state given loans and scholarships needed to pay for the price of college. Depending on the income level of the student and their family, the government determines how large an offer one can receive as financial aid.

One of the more pertinent sections of the workshop detailed the expanded role of the student in managing their financial aid. Although parents are often highly involved in the tuition payment process, Longoria stated that it was the role of the student to understand that the consequences of missing loan payments and damaging their credit.

Aaron Chen, a graduating senior, said, “My main worries for college tuition are because of the classes and housing. For students who would pay for themselves, I think they need to definitely have a good work ethic, especially if they are taking out loans. They need to be proactive, or the interest on those loans will harm them.”

The workshop also emphasized the importance of understanding the agreement made by accepting a loan. After receiving a monetary offer, students must choose what percentage of the offer they will accept, whether it be the majority or the entirety of the aid. A financial aid user must also consider the time they have to pay the money back and in what intervals.

Devansh Tandon, a senior, noted that additional charges, such as out-of-state fees, must also be realized when choosing loan offers from the government.

Tandon said, “I’m going to San Joes State, but am paying in-state for the first year because of my visa status. I have to pay a larger out-of-state fee for the next year of tuition though, so I’m planning on taking loans, working part-time, and doing scholarships.”

Due to the variety of financial offers available, a large factor in the decision of college attendees who apply for FAFSA is the amount of interest accrued over the years for a loan. If a student cannot pay for a hefty loan interest at the end of their college experience, then it may be better to seek alternative offers and payment methods.

“A lot of students don’t take into account how these [loans and debts] will impact their financial health if they miss payments,” Longoria said. “Parents can help their children by making sure that [the students] understand what they are signing up for.”