The collective student loan debt of college students in America has climbed rapidly over the past decade.

From tuition to housing and rent, student loans are designed to help students pay for expenses that come with post-secondary education or higher. However, according to Federal Student Aid, around 45.6 million college students owed a total of $1.6 trillion in student debt by the end of 2021.

“There are different types of student loans that you can receive,” said Gustavo Castillo, a financial education advisor for San Mateo Credit Union. “They’re for the purpose of funding your education.”

Students can apply for two types of student loans before graduating: federal and private student loans.

The federal government finances federal student loans, which have fixed and lower interest rates than private loans. And, they come in two different forms: subsidized loans, which allow undergraduate students to borrow a total of $57,500, and unsubsidized loans, which allow both undergraduate and graduate students to borrow a total of $138,500.

For subsidized loans, the government covers payments of undergraduate students with financial needs who are enrolled in school for at least half-time, during a period of deferment, or during a grace period of six months after graduation.

Unsubsidized loans are available to both undergraduate and graduate students, though borrowers are fully responsible for the interest while repaying loans.

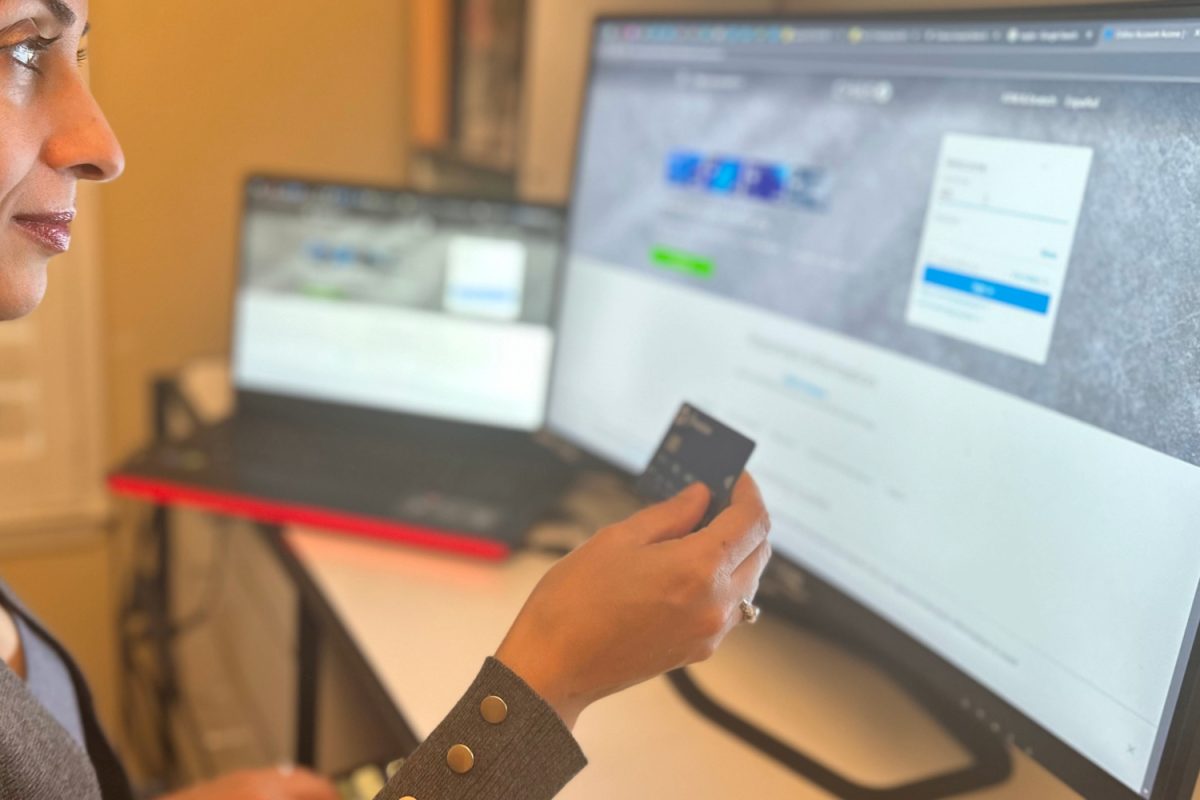

On the other hand, private lenders finance private student loans, such as banks and credit unions. Unlike in federal student loans, many lenders require repayments to be made while students are still in school and offer fixed or variable interest rates, which can fluctuate.

According to Education Data Initiative, the average federal and private student loan debts are $36,510 and $54,921, respectively. So, it is important to make sure to have a plan for repaying loans.

“As soon as you graduate, you have to start making payments to that [federal student] loan. But by that time, you already have your degree, and you’re able to find a full-time job,” Castillo said. “The best bet for a private student loan would be when you already have a degree you’re looking for to attend either a graduate school or when you already have a full-time job.”

Ideally, researchers believe borrowers should take ten years to pay off debts. However, that isn’t usually the case, as most take 20 years to repay their loans fully, depending on how much money you borrowed, when you started repaying student loans, or your repayment schedule. Such an extended period can be frightening and tiring for some.

“You can go years and years with this debt in your life for your education,” said Victoria Lehman, a sophomore. “It’s a hard thing to balance because education is really important, but at the same time, managing your money is just as important as an adult.”

Luckily, some matters can be considered before applying for a student loan.

Scholarships and grants are common tools for cutting off college costs. Scholarships are merit-based, meaning that awards would be given out based on the students’ academic achievements, extracurriculars, and more. Grants are distributed based on financial need, and they don’t need to be repaid if their conditions are met.

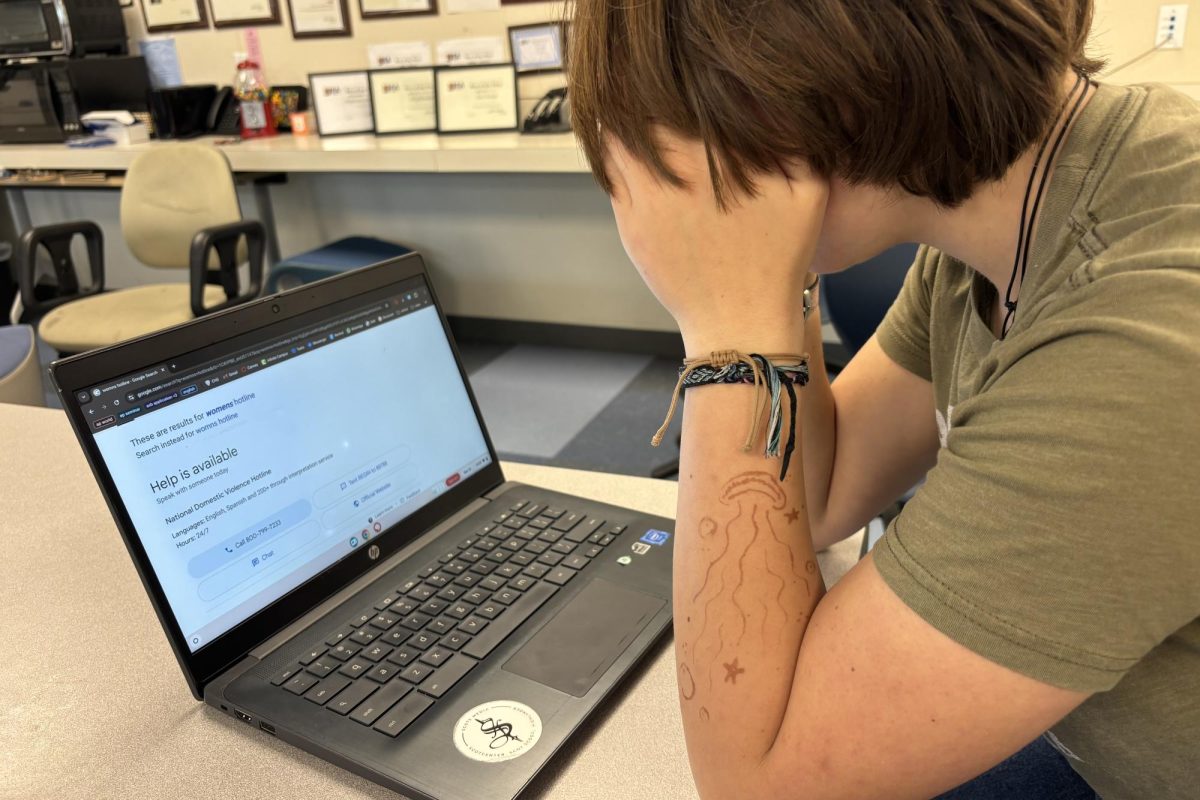

There is a misconception surrounding the Free Application for Federal Student Aid (FAFSA), which helps students who need financial aid receive grants from the government.

“Students think that they’re not going to qualify for federal student aid, based on their income,” Castillo said. “It’s really not about the income; it’s a lot of things that can differentiate or can change your status.”

Some may not qualify for grants and some federal student loans, but specific scholarships may require an Expected Family Contribution (EFC) number and FAFSA information to apply.

Students can also apply for a local community college for the first two years of undergraduate education and then transfer into a four-year university to lower college costs without borrowing student loans.

“There’s much more flexibility in [going to a community college first] and much less pressure,” said Kayla Hogan, a senior. “I think people, especially in the Bay Area, feel a lot of academic pressure and often get caught up in big-name schools, and some even look down on community college, when in reality there are some pretty amazing community colleges in our area that can provide you with a great education or serve as a stepping stone to your future goals.”

All in all, student loan debt can significantly affect a student’s life, depending on their situation and pathway, as it can either make or break their career and financial aspirations.

“There’s no guarantee that your education will pay for itself,” Hogan said. “You’re kind of betting on the fact that you will be able to pay it off in a timely manner, but if you can’t, there are pretty large consequences.”