As dark clouds loom, not all are prepared for financial storms. Saving for a rainy day starts to feel impossible with rising costs and expenses. In a world where people are immediately influenced by what others have, saving money isn’t the only problem. It creates a cycle where not everyone can escape financial vulnerability.

According to the Pew Research Center, the financial divide between the lower, middle, and upper classes has grown, resulting in more people falling into the lower-income category.

“I was in a situation where I had no money. I could only buy toiletries. When you get to a situation like that, you’re just in survival mode,” said Christine Ayroso, a real estate agent who sells homes in Fairfield.

Middle-class families are constantly bracing for life’s unexpected financial storms. Whether it is healthcare or education, maintaining an affordable lifestyle has become more challenging in the Bay Area due to the higher living costs.

Balancing costs and quality of living

The cost of living in San Francisco is 71% higher than the national average, according to the Cost of Living Index, making it harder for residents to save for more necessities, such as rent and food.

There is a simple explanation for the high living expenses in Silicon Valley: there is more demand than supply.

“When interest rates go down, most people buy money to buy houses. It increases a person’s ability to borrow money from the bank. But when you combine the fact that interest rates are low and there are more buyers than sellers, it causes the price of housing to increase,” Ayroso said.

According to Ayroso, housing prices started to increase during the pandemic. There are not enough houses for sale in San Mateo County, causing prices to keep going up.

“People are forced to go where they can afford to live, and with inflation, they are pushed to go farther from Silicon Valley, such as Fairfield, Tracy, and Manteca. Up north, people live in Concord, Pittsburgh, typically the outskirts of cities,” Ayroso said.

Zoning laws have also influenced residents to move out of the Bay Area. The need for more housing results in higher property taxes and rental prices, presenting challenges for people trying to find reasonably affordable housing.

“Strict zoning and the failure to build sufficient new housing in the Bay Area has led to increases in the cost of renting and buying a home. The existence of rent control also tends to lower the supply of available rental units, exacerbating housing shortages,” said Audrey Guo, an assistant economics professor from the University of Santa Clara.

Engineers and those with high incomes can afford to continue renting in Silicon Valley, but people who have been pushed out of the Bay Area and who keep their jobs make a longer commute to work.

According to Ayroso, people in Manteca and Tracy sacrifice more time with their families. At the same time, others also choose to live in other states instead, such as Texas, Oregon, and Nevada.

“A lot of companies are moving to Texas. Texas imposes less taxes, making it easier for companies to set up there and more affordable for people. Sometimes, it can even result in a higher quality of living,” Ayroso said.

Paying the price for eating well

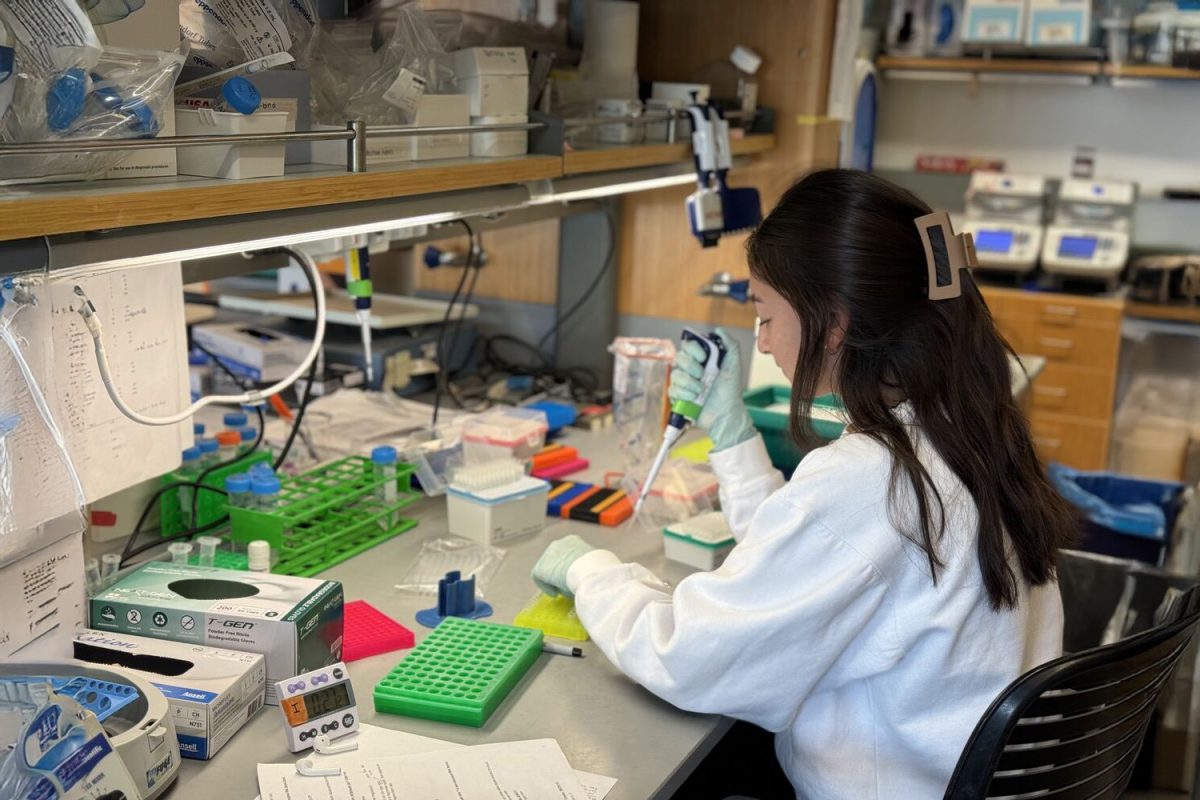

Obtaining the foods necessary for a better lifestyle can be challenging in a world where people are more focused on eating a healthy diet.

For example, one bowl of salad from Raley’s comes with lettuce, carrots, red cabbage, cucumbers, grapes, and balsamic vinegar, which costs $9.98. A pack of 24 instant noodle cups only costs $13.99 at Costco.

According to the National Library of Medicine, food prices have increased in recent years due to the impacts of the COVID-19 pandemic on global food systems, climate change, and wars.

“Because the prices of your utilities are going up, you have to get creative with what you eat and how you spend,” said Michael Nario, a San Leandro resident.

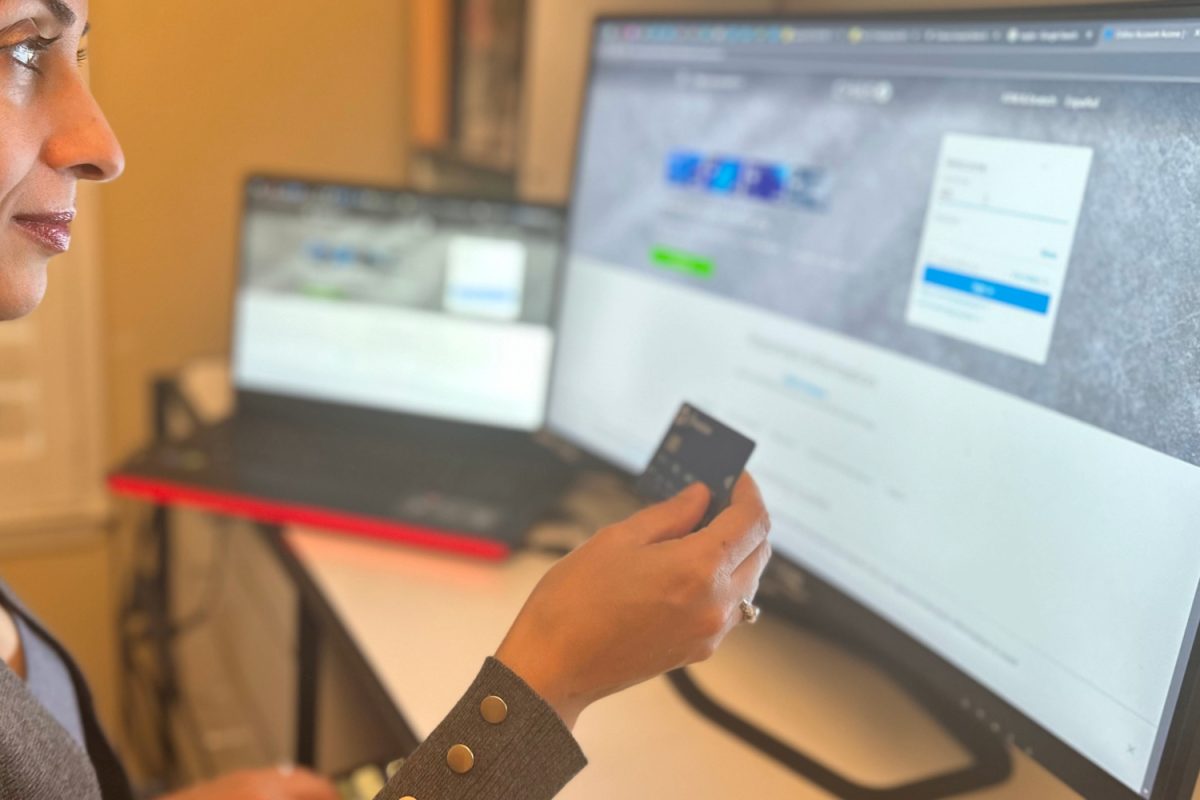

Nario has been using food apps to get discounts on his food and drinks, such as coffee. Since he started working, he adjusted his spending habits and has to continue finding new ways to save money due to inflation.

“My coffee at McDonalds used to be 99 cents. When the price became $1.29 because of inflation, I was shocked,” Nario said.

Due to rising costs, some people are forced to sacrifice their health. People with lower income are more prone to obesity, according to the NIH, with feelings that one has a lack of control over their lives, stress, low self-esteem, and social isolation kick in, which can lead to a higher risk of obesity. Income dictates what someone can get and restricts access to healthier foods.

“It’s always been an ongoing effort to figure out how to frame your expenses and develop ways to increase your income. You’re always on the lookout for any opportunities that might lower your expenses,” Nario said.

Many, like Nario, have concerns about rising costs in everyday purchases, as small price increases can feel significant over time.

Obtaining more with less

According to the University of Manchester, because our culture is materialistic, people buy what they immediately like, influencing them to overspend. Overconsumption negatively affects spending habits and budgets, creating more challenges to save money.

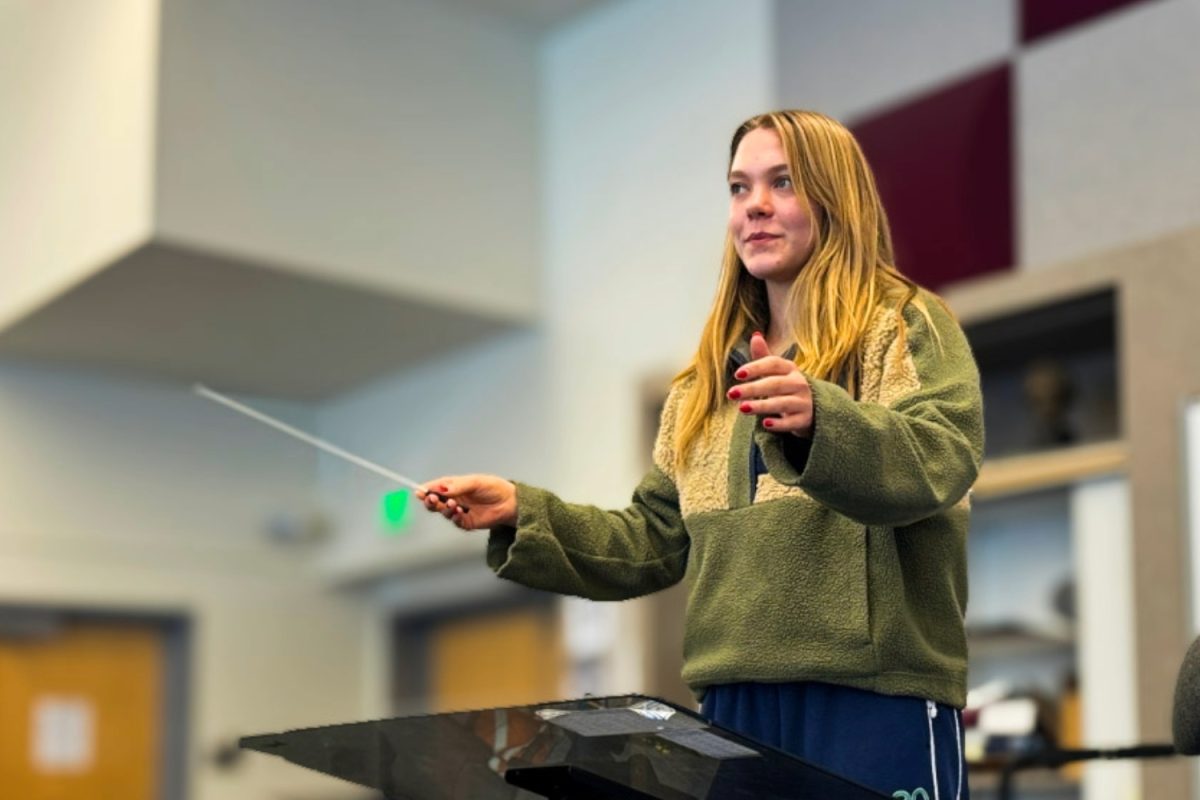

Materialism has caused many to prioritize instant gratification over financial stability, which can lead to cycles of debt and a lower quality of living. Finding ways to save money can be challenging, but it results in creative thinking and better analytical skills.

“You have to prioritize what is important,” Ayroso said. “It’s important to enjoy life, but it’s also important to live within your means.”