A wave of early retirement is sweeping the United States.

Young investors leave work and go home with their virtual pockets full of money and their accounts positively emanating success. And it’s all due to a well-played gamble: an early investment in Bitcoin.

Bitcoin, a widespread cryptocurrency, was created based on ideas set out in a whitepaper by Satoshi Nakamoto, a pseudonymous individual, in 2009. To this day, the original creator or creators of the technology are still unknown.

Elon Musk, the chief executive officer of Tesla Inc. and the founder of SpaceX, recently invested $1.5 billion in Bitcoin on Feb. 8. The result was a 76% rise in the price of the cryptocurrency and an eventual 13% drop after Musk went online to tweet that the Bitcoin prices “do seem high.”

On Feb. 19, Bitcoin’s market cap hit and surpassed $1 trillion for the first time, with a single Bitcoin averaging around $55,000. According to Sergei Vosnesenskiy, a staff member at Prisma Health-Upstate and a current stockholder, the Bitcoin price is sure to fluctuate even more in the future.

“Bitcoin is purely speculative. In other words, it costs as much as people choose to invest in it at any given moment, and because of this, it can very quickly change its worth. Nobody can truly predict the future of Bitcoin, and that’s why it is a very volatile currency,” Vosnesenskiy said.

According to Vosnesenskiy, the unpredictability of cryptocurrency makes this type of money a risky investment to many stockholders. One day, the market for Bitcoin can soar to new heights, but the next day can drop back down.

Furthermore, Bitcoin is not controlled by banks or the government; instead, it is kept on a public ledger that everyone has transparent access to.

“Bitcoin enables certain uses that are very unique. I think it offers possibilities that no other currency allows. For example, the ability to spend a coin that only occurs when two separate parties agree to spend the coin; with a third party that couldn’t run away with the coin itself,” said Pieter Wuille, a Bitcoin Core developer and the co-founder of Blockstream.

All Bitcoin transactions are monitored by a massive amount of computing power. This process is also known as “mining.”

“[Bitcoin] might not be as stable as physical currency due to the presence of crypto mining, which runs calculations that can reward a user with crypto tokens virtually for free. Unlike gold, which is a rather solid investing choice since it is a finite resource and thus has a fixed or rising value, Bitcoin is not grounded,” said freshman Pranav Kamat.

Yet despite the speculation around cryptocurrency, Bitcoin is looking to become a powerful force in finance and the stock market.

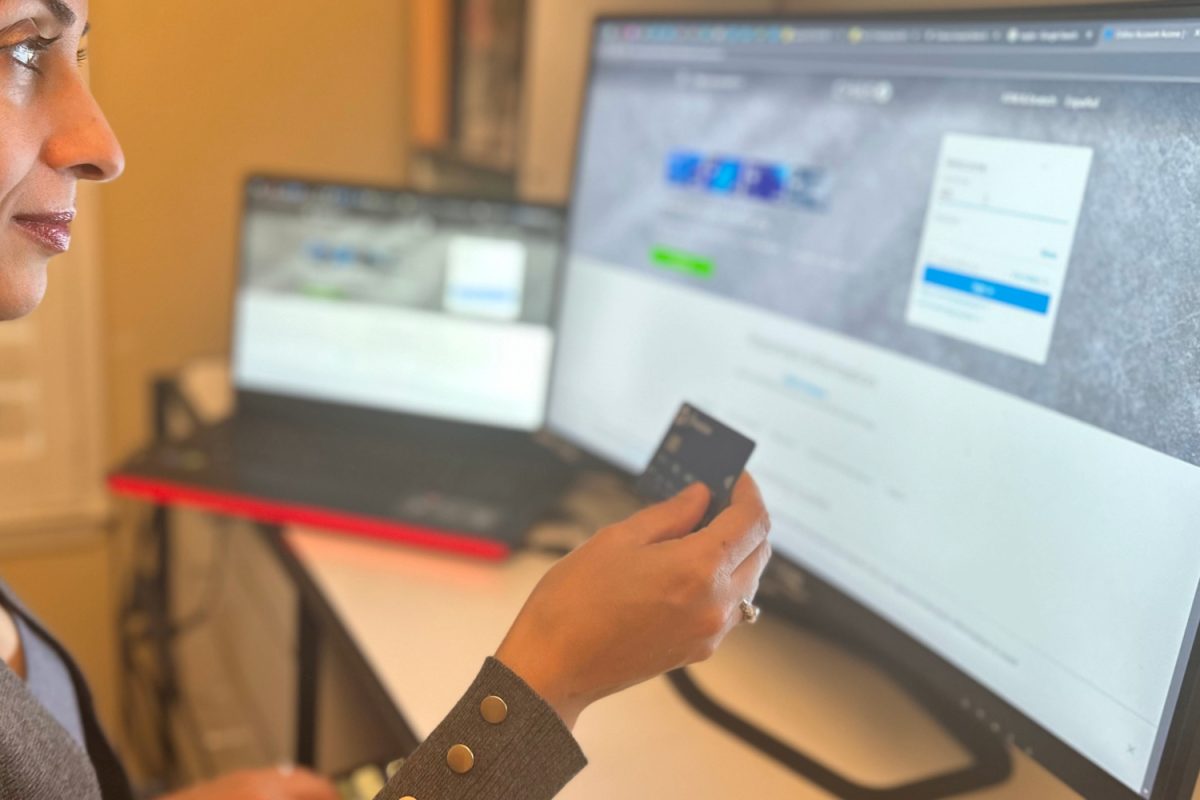

Companies like PayPal Holdings Inc., Visa Inc., and MasterCard Inc. recently accepted Bitcoin as a payment method. Additionally, Central banks like the Federal Reserve and European Central Bank are researching how to digitize their own sovereign currencies.

Meanwhile, Ark Investment Management CEO Catherine Wood and Fidelity Investments CEO Abigail Johnson have introduced popular funds that let investors add crypto to their portfolios.

“Bitcoin has generally created a lot of economic opportunity and blockchain technology as a whole, giving more power to average investors. Bitcoin especially might cause an influx of money into cryptocurrency, and it will also hopefully lead the way for many companies and jobs to be created, benefiting everyone at the [possible] expense of economic stability,” Kamat said.

There are many ways of gambling in this world, and one of them is buying cryptocurrency. It may or may not be the currency of the future, but one thing is for sure: Bitcoin is currently making its mark upon the world.

“Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value,” said Eric Schmidt, former CEO of Google.