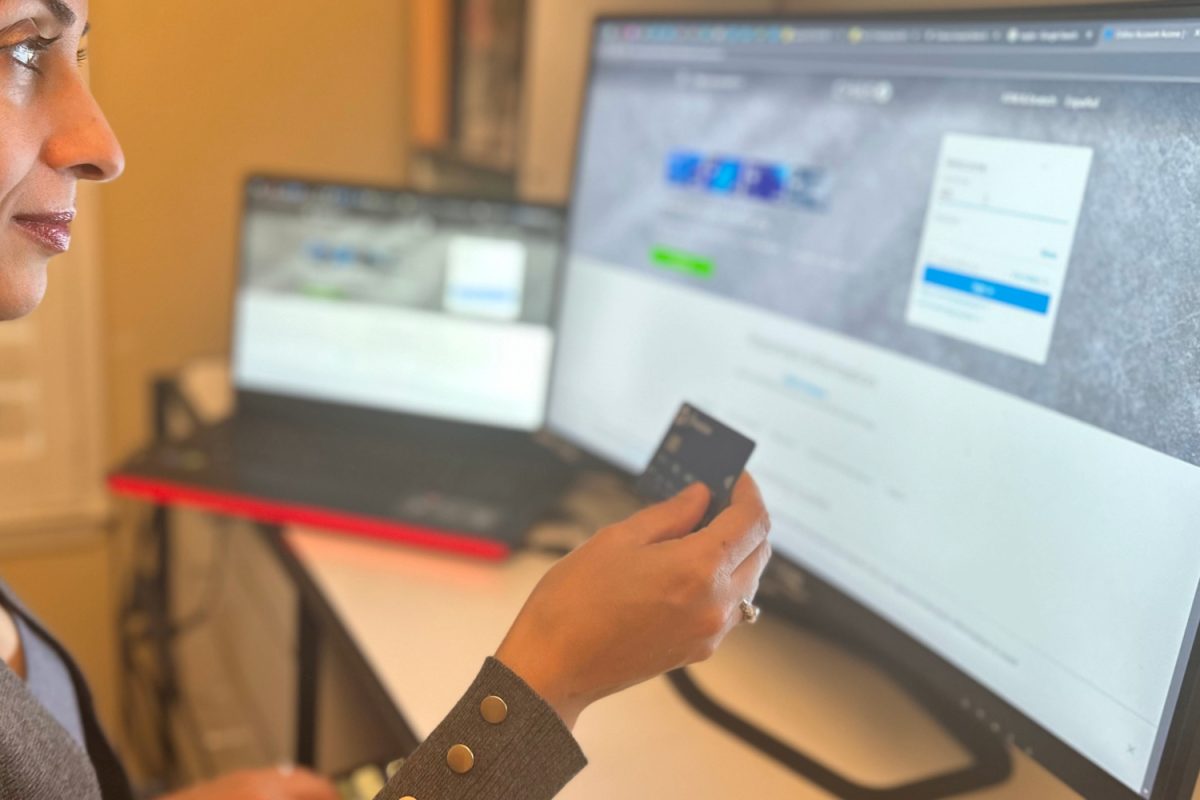

Shoppers around the country have recently seen everyday items become unaffordable as the world feels the effects of a devastating inflation crisis.

In economics, inflation is described as an increase in the price of items. As goods become more expensive, each unit of currency can purchase less, leading to a decrease in the currency’s value.

In the past two years, inflation in the country has been unnaturally high. While inflation rates usually hover around 3%, the inflation rate for the year 2022 stands at 7.5%, the highest it’s been in 40 years.

This increase in price does not have a single cause, however. Instead, it comes from a combination of factors, one of which is the COVID-19 pandemic.

“There’s a lot of spending going on in the United States, from people who got stimulus checks because of the pandemic. Now they have all this money that they’re spending, and it’s causing inflation to go up because there are more people and there’s more money out there,” said Carlmont business teacher John Rowe.

Also in the equation is the recent conflict between Ukraine and Russia. As a major oil exporter, sanctions placed on Russia affect every part of the supply chain. As of March 16, the price for a gallon of gasoline in the Bay Area is more than double what it was in 2016, according to the Energy Information Administration.

“The supply is lowering for worldwide oil potentially because some people are boycotting Russian oil, and because there’s an oversupply, there’s more demand for it. That’s going to increase prices,” Rowe said.

These increasing prices have a detrimental effect on young drivers in the community. Carlmont sophomore Tyler Williams believes that other forms of transportation may be more viable.

“A full tank for me right now is about $60. For a teenager that does not have a job, that is very bad. It makes me consider other possibilities for transportation,” Williams said.

Inflation disproportionally affects members of the lower class and those with a fixed income. According to Rowe, they are at a disadvantage when the economy sees inflation.

“Prices go up, and when you’re on a fixed income, it’s very difficult because you can’t afford things. So it particularly hurts people who are in fixed income, either because of a government job or maybe the government is paying them money like welfare,” Rowe said.

One of the largest victims of the price increase are those supplying the goods. Lunardi’s, a local grocery store in Belmont, has been hard-hit by inflation.

“It’s harder to negotiate with the suppliers. There are also shortages of some items. People start shopping according to their budget,” said store manager Bill Go.

Despite its struggles, Lunardi’s is doing its best to support shoppers.

“We negotiate with companies, trying our best to bring the price down, such as buying in bulk,” Go said.

The first steps to combat inflation are being taken by the Federal Reserve System (Fed). As the central banking system of the U.S, the Fed controls interest rates, or how expensive it is to borrow money. The Fed hopes to discourage spending and slow down inflation by raising interest rates.

“Interest rates have never been this low before. And so they’re raising the interest rates, a quarter of a percentage, 0.25%, four times a year for the next two years,” Rowe said.

Although measures are being implemented to fix the crisis, it is uncertain when the economy will see prices return to normal.

“They will tell you anything at this point. We don’t really know when inflation will stop,” Go said.